Laws dot-com legal forms guide form 1120 is a United States Internal Revenue Service tax form used for corporate tax returns of companies claiming C corporation tax designation. The form 1120 can be obtained through the IRS's website or by obtaining the documents through a local tax office. The tax form is to be filed by a corporate taxpayer in order to calculate corporate taxes for the year first pr the name of the corporation along with contact information in the top box of the form pr the employer identification number date of incorporation and total assets as required under the tax codes record the gross income of the corporation in lines one through ten include gross receipts goods sold gross profits dividends interests rents royalties capital gains net gains and any other income sources add all of this and put the total amount of gross income in line 11 next list all deductions from the year in lines 12 through 28 add the total amount of deductions and put that amount in line 29 calculate the total taxes paid and tax credits in lines 30 through 35 to calculate your tax obligation or tax refund the officer of the corporation can sign the tax return and the preparer must pr their information in the final box additional schedules will be required for attachment with your form 1120. If your company is deducting the cost of goods sold from gross income these amounts must be accounted for in Schedule A. If dividends or special deductions have been claimed on the form 1120 they must be listed in Schedule C for the compensation of corporate officers. These amounts must be accounted in Schedule E additionally schedules J and K must be attached indicating the accounting method used by the corporation and...

Award-winning PDF software

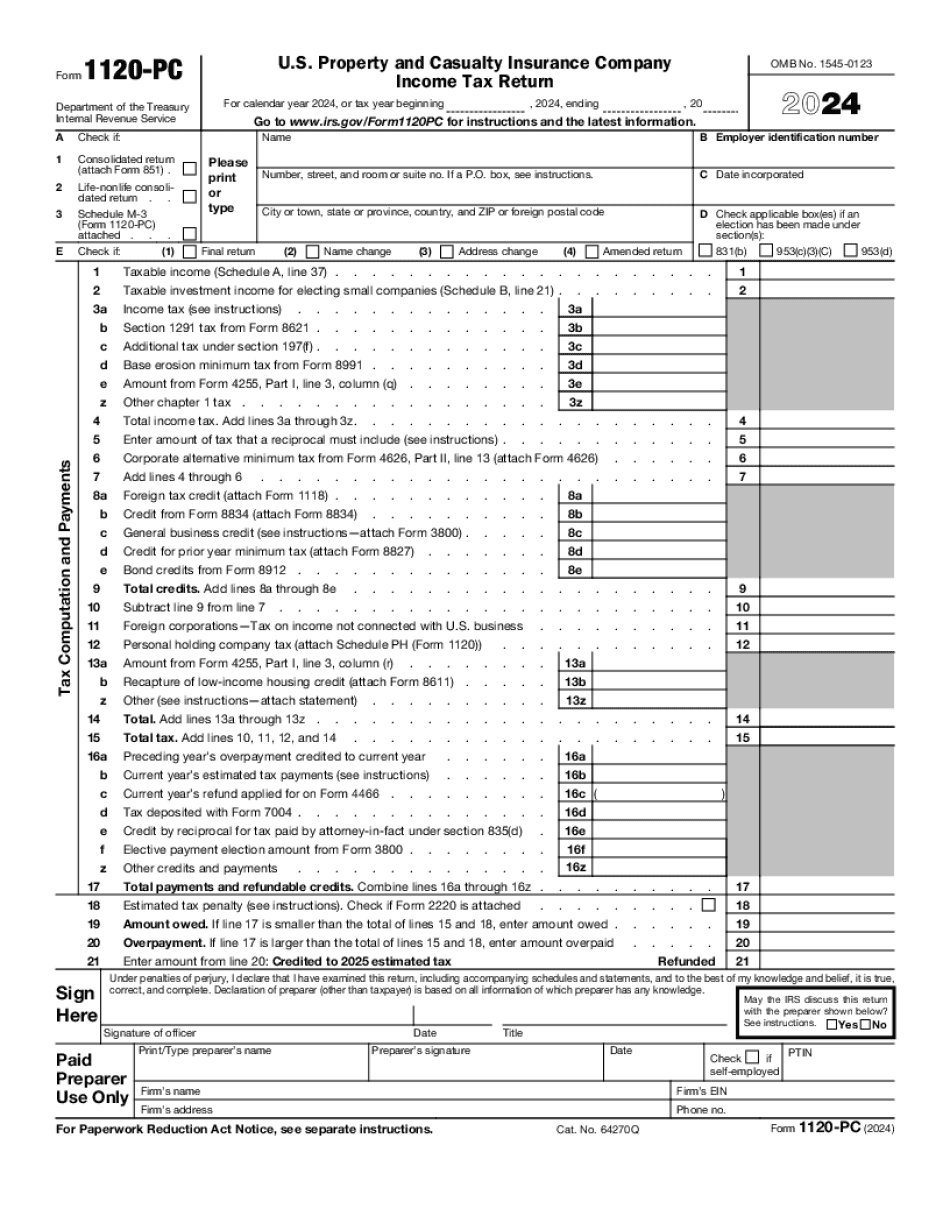

How to prepare Form 1120-PC

1

Open up a fillable Form 1120-PC

Just click Get Form to open the template inside our editor. There is no need to download the file-it is possible to fill out the form online through the device.

2

Fill the papers

Fill the papers within a handy editor, offering precise details in each field. Include your electronic signature if needed.

3

Share the file with others

Once the record is filled in, you can save it in a recommended formatting, download it, or print out it. It is possible to send it by e-mail, USPS and fax or Text messages.

What Is 1120 Pc naic?

Online technologies allow you to arrange your file administration and raise the efficiency of your workflow. Observe the brief guideline in order to fill out IRS 1120 Pc naic, stay away from errors and furnish it in a timely manner:

How to fill out a 1120 Pc?

- On the website with the blank, click on Start Now and pass to the editor.

- Use the clues to fill out the relevant fields.

- Include your individual details and contact data.

- Make sure that you enter proper details and numbers in proper fields.

- Carefully check the content of your document so as grammar and spelling.

- Refer to Help section should you have any concerns or contact our Support staff.

- Put an electronic signature on your Form 1120-PC printable using the support of Sign Tool.

- Once document is completed, press Done.

- Distribute the ready form via electronic mail or fax, print it out or download on your gadget.

PDF editor enables you to make changes in your Form 1120-PC Fill Online from any internet linked device, customize it in line with your needs, sign it electronically and distribute in several means.

What people say about us

Good reasons to use electronic digital forms or paper records

Video instructions and help with filling out and completing Form 1120-PC