TurboTax Business 2018 tax software is available for PC download. - This software is most suitable for small businesses that operate as a partnership, S corporation, C corporation, multi-member LLC, or for trusts and estates. - It allows you to prepare and file your business or trust taxes with confidence. - With TurboTax Business, you can receive guidance in reporting income and expenses, helping you effectively manage your finances. - Maximize your bottom line with industry-specific tax deductions. - This software also enables you to create W-2 and 1099 tax forms for your employees and contractors. - Additionally, TurboTax Business 2018 includes five free federal e-files for easy and efficient filing. - State preparation is available as an additional feature (available for Windows only). - For the best price, click the link in the description to get this product today.

Award-winning PDF software

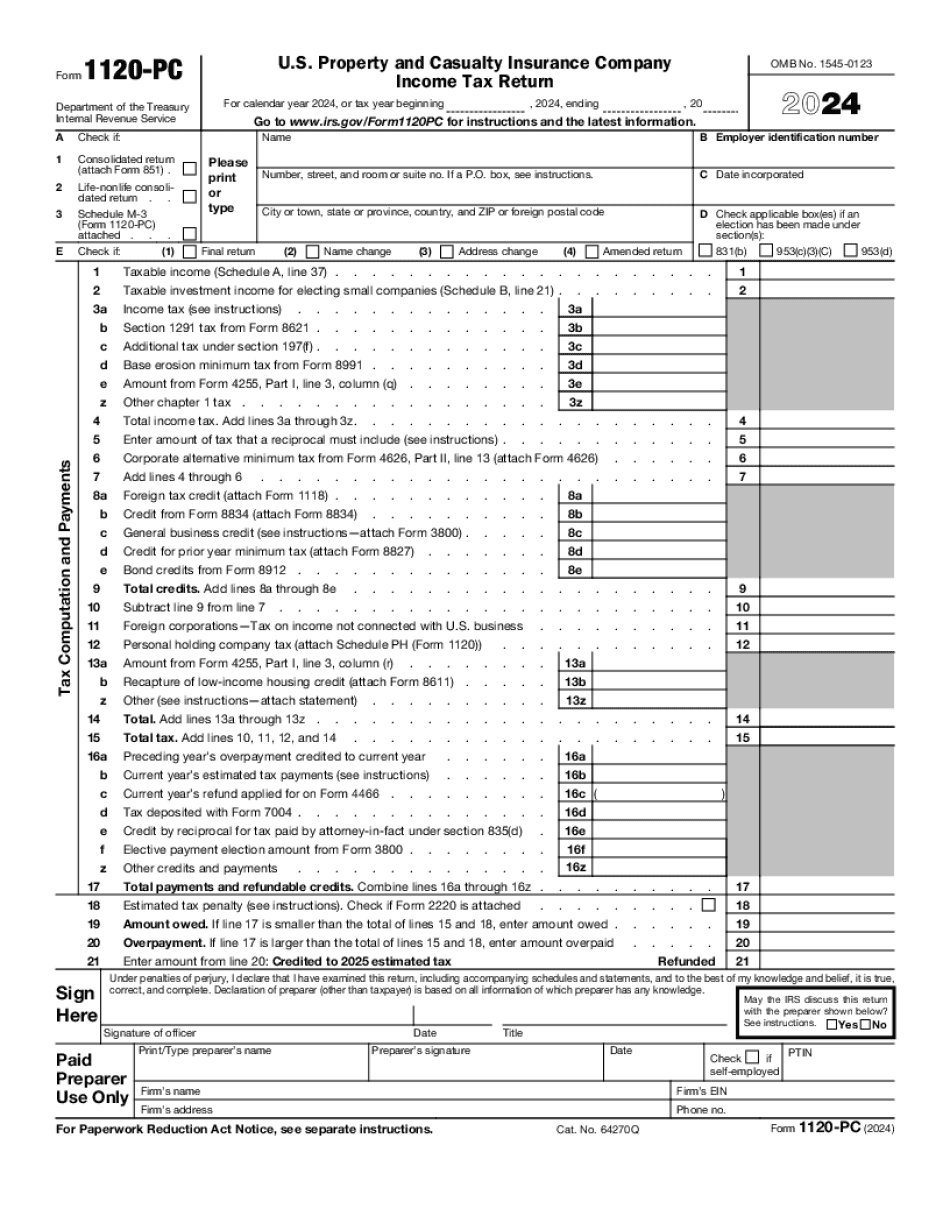

1120-pc instructions 2025 Form: What You Should Know

The corporation had at least a quarter of its gross income from any qualified investment for the tax year required to calculate tax deductions for that quarter. For more information on tax deductions and tax year filing requirements see Form 1120-PC and the Instructions to Schedule C. 1. Schedule A for any members of the unitary group. The Form 1120 can be obtained from the Illinois Secretary of State or its agent through the U.S. Department of Treasury via Electronic Filing by Individuals and Businesses. 2. Any other form required by state or local law (except those for the Illinois Public Aid Education Savings Trust fund, the Illinois Small Business Development Center, the Illinois Housing Development Authority, or the Illinois State Board of Education). If the return is to be filed electronically through the U.S. Department of Treasury, click to Electronic Filing by Individuals and Businesses. Enter each taxpayer's: name, birthdate, physical address, social security number, and last five digits of the taxpayer's Social Security number (SSA#). If an individual has a Social Security number based on his or her U.S. Social Security number, the system will generate an account number. If you are unable to enter the last five digits of a taxpayer's Social Security number, you can enter the SSA#, followed by the last six digits, one space to the right. Form 1120-PC Taxpayer Notice 2025 (PDF, 12.5 MB) Notice 2025 (PDF, 12.5 MB) Form 1120-PC Instructions for Filing Form 706 (PDF, 669 KB) Filing Form 706 (PDF, 673 KB) 1. The return must be filed using the IRS electronic filing system and include: • The person's name, address, and date of birth. • If the person was required to file Form 1120-PC (2017 or earlier), form number (Form 1120-PC-2017). • If it was not required to file the 2025 Form 1120-PC (but was required to file it for prior years), form number (Form 1120-PC-2015). • The taxpayer's Social Security number. • The gross and non-gross income of the unitary group members (if any). • A computation of taxable income. Do not file the return as a paper form.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120-PC, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120-PC online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120-PC by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120-PC from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1120-pc instructions 2025