Award-winning PDF software

2018 Form 1120-Pc - Internal Revenue Service: What You Should Know

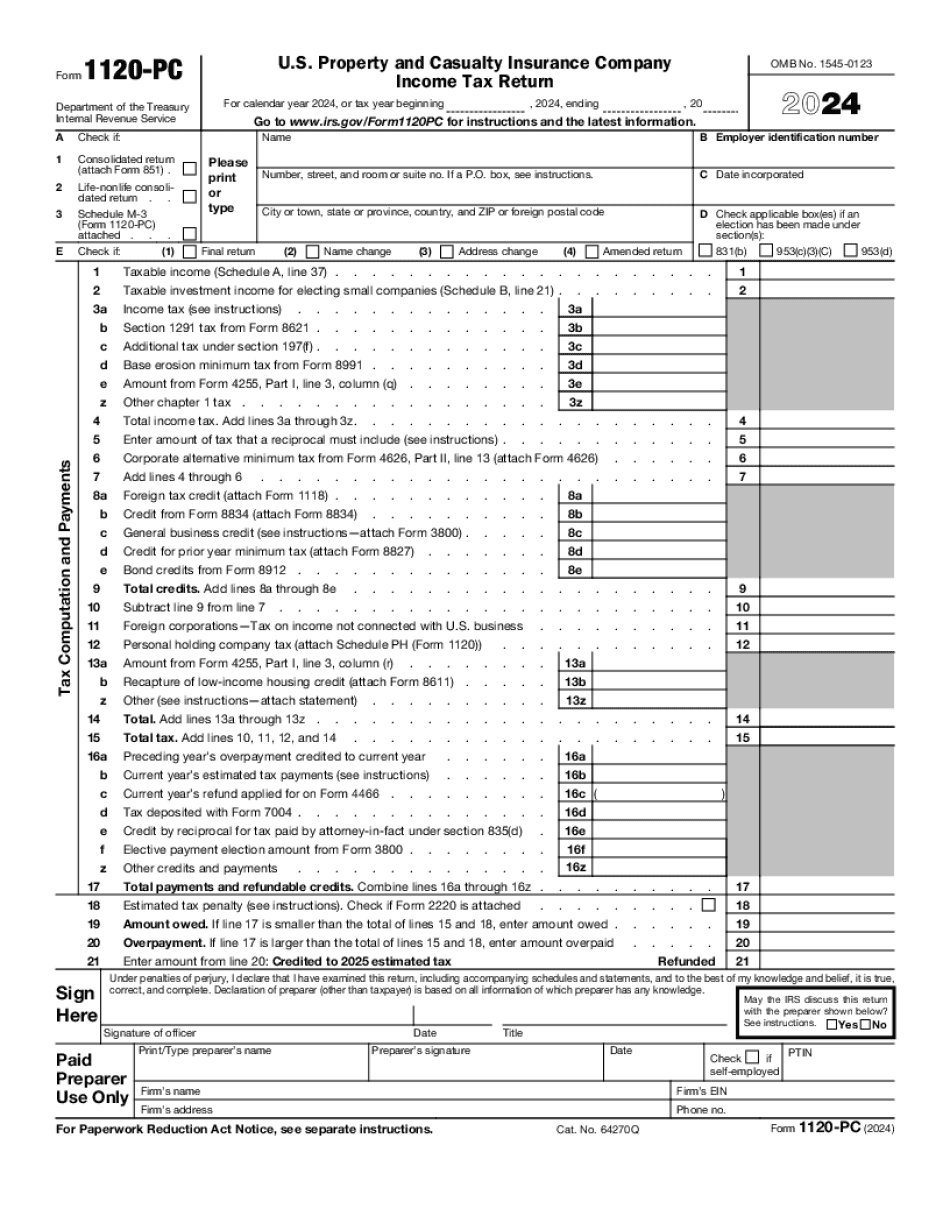

You will have to use this form if your total combined business gross income for taxable years before becoming a corporation is greater than 75,000. 1-2 — A tax year includes: a 1. An initial year if the corporation began the tax year after 12/31/2017; 2. A later tax year if either: a. The corporation began the second taxable year before the first taxable year; or b. The corporation filed U.S. Form 1120, but not filed U.S. Form 1120-L (because the second taxable year begins after the first taxable year). 2018 Instructions for Forms 1120–PC, Income Tax Return 1-1 — How to prepare the income tax return. The forms and instructions to calculate your tax will apply to all income (as discussed above in 3.13). 1-4 — How to get a Form W-9 or equivalent? (for corporations) Income must be reported on Form 1040 or on Form 1040NR, U.S. Income Tax Return for the fiscal year. (or Form 5471, Employee's Withholding Allowance, for self-employed individuals) If you have tax-exempt wages, pay the excess over 200, under a Schedule C. If you do not qualify, but need to file an itemized deduction, you can calculate your tax as follows. 3.23.2018 Forms for Illinois Taxpayers. Illinois is filing state tax returns. There will be two sets of filing instructions and returns, one for individuals and the other for corporations: 3.23.2018 Forms and Instructions for Illinois Taxpayers 1-1 — Form W-9 The W-9 is the tax form for all business in Illinois. It must be completed and signed by all persons who: • Work for the business; • Rent, lease, or otherwise provide a place or facility for using the business; • Own or control any part of the business; and • Participate in the ownership, management, and control of the business. A business with an annual gross merchandise item is one that sells more than 250,000. 3.23.2018 Forms and Instructions for Illinois Taxpayers 1 -2 — Instructions for Forms W-2G, Employer's Withholding Allowance, and Form W-2M. 3-16 — Instructions for Forms W -2G, Employer's Withholding Allowance and Form W-2M.

Online choices make it easier to to arrange your doc management and strengthen the efficiency of the workflow. Adhere to the quick information for you to full 2025 Form 1120-PC - Internal Revenue Service, keep clear of mistakes and furnish it within a timely manner:

How to finish a 2025 Form 1120-PC - Internal Revenue Service on the internet:

- On the website together with the form, click Start off Now and go into the editor.

- Use the clues to complete the applicable fields.

- Include your personal facts and phone facts.

- Make guaranteed that you choose to enter accurate information and figures in best suited fields.

- Carefully test the subject matter with the type in addition as grammar and spelling.

- Refer to support portion when you've got any queries or deal with our Aid group.

- Put an electronic signature on your own 2025 Form 1120-PC - Internal Revenue Service when using the assist of Indicator Software.

- Once the shape is completed, press Done.

- Distribute the ready sort through electronic mail or fax, print it out or help save with your gadget.

PDF editor allows for you to definitely make variations for your 2025 Form 1120-PC - Internal Revenue Service from any on-line connected device, personalize it as outlined by your needs, signal it electronically and distribute in several tactics.