Award-winning PDF software

2018 - Instructions For Form 1120: What You Should Know

Per taxpayer. If the corporation does not hold a property in Illinois, enter 2,000,000.00 on the bottom of the line 46. Use a calendar year for reporting purposes. You must compute the tax based on an estimate of income for that year. On a per-taxpayer basis, apply the gross income tax rate to the number of taxpayers and the gross income, or net income for an S corporation, for which a tax liability is asserted. On a per-partnership basis, divide the total amount of any loss from a business for the period by the overall partnership's assets at the end of the period, including any property owned by the partnership. Enter all amounts for your portion of the partnership on the line 27. For a partnership that does not exist until the taxpayer enters it on paper, divide the partnership's assets at the end of the period by the number of partners. 2018 Instructions for Form 941 — IRS On line 27, enter your own tax and pay to the Treasury Department. If you are a partner in the partnership, enter your partner's tax on lines 11: income by partner; and income by partnership, and pay to the Treasury Department. You must also enter on line 27 any partnership tax paid by other partners. On the line 27, enter on the last page, the partner's tax payable to the United States of America on Form 941. 2018 Instructions for Form 940 — IRS Use Form 940, U.S. Individual Income Tax Return of an Individual or a Fiduciary, to report income for the year. IRS Form 941 On Form 940, use the following instructions to report partnership income for the tax year: Complete Schedule 941. 2018 IR-1120 Instructions — Rhode Island.gov Step 6, line 44, line 45, Form CO‑0206 from 2025 tax year, Form CO‑0208 from 2025 tax year. Complete Form CO‑0206. Your Form CO‑0206 should reflect the new federal tax brackets and the new filing requirement for partnerships. Form 8886 Instructions — Form 8886 — IRS Complete the following instructions to report the tax for 2018. Do not complete the instructions to report the tax for 2017. Use Form 8886, U.S. Tax Return for Estates and Trusts. (The following tax codes will not be used in 2018.

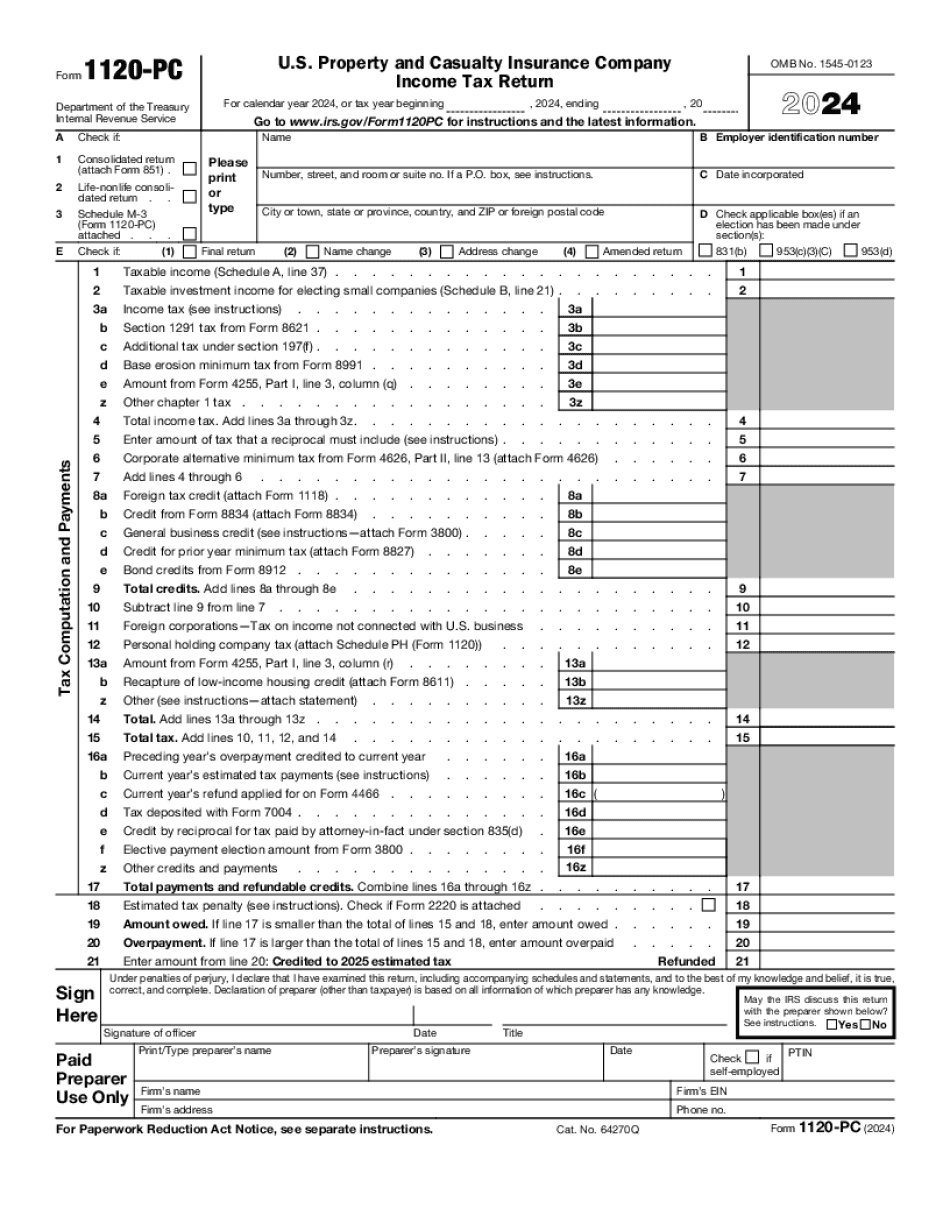

Online remedies help you to to prepare your document administration and increase the productivity of your respective workflow. Carry out the fast guide so that you can entire 2025 - Instructions for Form 1120, refrain from errors and furnish it in the timely fashion:

How to complete a 2025 - Instructions for Form 1120 on-line:

- On the website with all the sort, click Commence Now and pass with the editor.

- Use the clues to complete the applicable fields.

- Include your own facts and contact knowledge.

- Make absolutely sure which you enter appropriate knowledge and numbers in appropriate fields.

- Carefully check the content material on the sort in addition as grammar and spelling.

- Refer to assist segment when you've got any queries or deal with our Help workforce.

- Put an electronic signature on your own 2025 - Instructions for Form 1120 while using the guide of Signal Software.

- Once the shape is completed, press Done.

- Distribute the prepared sort by means of email or fax, print it out or preserve with your gadget.

PDF editor makes it possible for you to definitely make changes to the 2025 - Instructions for Form 1120 from any web connected device, customise it as outlined by your preferences, sign it electronically and distribute in several techniques.