Award-winning PDF software

Instructions For Irs Form 1120-Pc "us Property And Casualty: What You Should Know

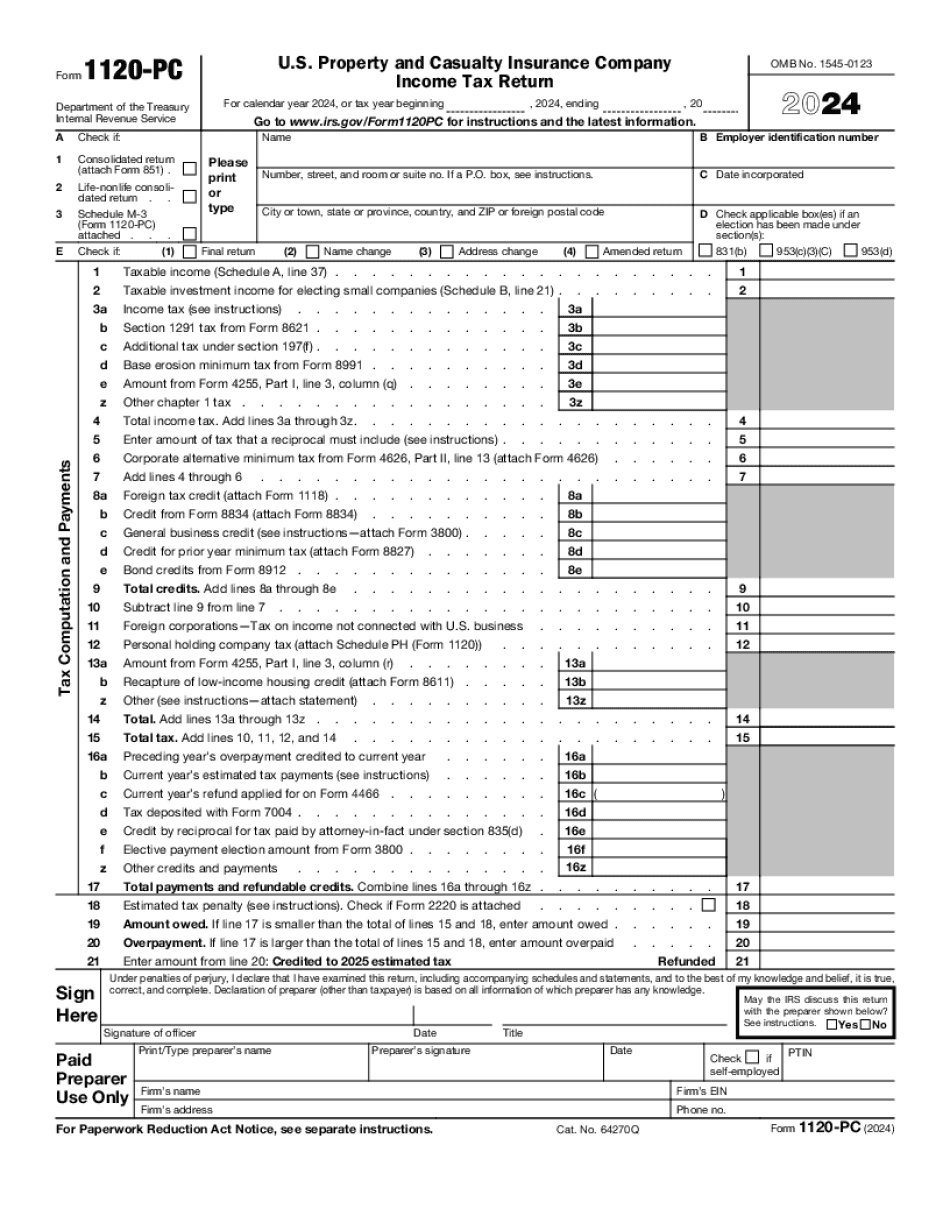

Form 1120-PC — 2025 — IRS (Schedule M-6) and Schedule M-14 (Form 1120-PC), Financial Statements (PDF) — IRS Schedule M-7 must be filed for these forms. Instructions for Schedule M-7 (Form 1120-PC) — IRS See instructions for Schedule L (Form 1120-PC) to report net income from U.S. property and casualty insurance companies in 2017. To determine if any property and casualty insurance companies qualified as real property under IRC Section 1221(b)(2)(A)(ii) in 2017, see the FAQ below. A. In general. A qualified rental property (i.e. a rental property other than a principal residence) is property for rental use which meets the definition of a commercial property under IRC Section 1221(b)(1)(C) and is used principally for its productive uses within the taxable year. A qualified residential rental property is a rental property other than a principal residence which meets the definition of a residential rental property under IRC Section 1221(b)(1)(B) and has no use other than in the rental of real property, whether occupied as a principal dwelling or a secondary dwelling. Taxpayers seeking to treat their rental property as a qualified rental property, can do this by filing Schedule M-3, Net Income from Residential Properties (PDF). B. Qualified rental property. A qualified rental property is any rental property other than a principal residence, which is used, and principally used, for its productive uses within the taxable year. B.1. Examples. A qualified rental property is a rental property described in paragraph (2)(A)(ii) of an example described in paragraph (6)(S). A taxpayer qualifies as a single taxpayer under section 267(b). Because the taxpayer is a single taxpayer who files a joint tax return, paragraph (7)(A) of that example provides that the taxpayer has a disqualified housing credit balance of 500,000. Because the landlord is a qualified rental contractor, paragraph (10) gives that contractor the tax treatment of an independent contractor because the tenant is acting as a principal; therefore the taxpayer is considered a property owner for purposes of IRC Section 1342 and as described in paragraph (10)(B)(ii)(E). The tax treatment of the landlord and the tenant, combined with the rental of the property, constitutes the basis for the property.

Online solutions make it easier to to prepare your document management and increase the productiveness of the workflow. Stick to the fast handbook as a way to total Instructions for IRS Form 1120-PC "US Property and Casualty, keep away from mistakes and furnish it inside a well timed fashion:

How to complete a Instructions for IRS Form 1120-PC "US Property and Casualty on line:

- On the web site along with the sort, click Start Now and move on the editor.

- Use the clues to fill out the relevant fields.

- Include your individual information and phone knowledge.

- Make guaranteed that you enter correct information and facts and figures in appropriate fields.

- Carefully examine the articles on the form at the same time as grammar and spelling.

- Refer to assist part should you have any queries or tackle our Support workforce.

- Put an digital signature on your own Instructions for IRS Form 1120-PC "US Property and Casualty along with the enable of Indication Resource.

- Once the shape is finished, push Carried out.

- Distribute the all set form by way of e mail or fax, print it out or help you save on your own gadget.

PDF editor helps you to make adjustments for your Instructions for IRS Form 1120-PC "US Property and Casualty from any web linked device, customize it in keeping with your needs, signal it electronically and distribute in numerous ways.