Internal Revenue Code of 1986: U.S. Business Corporation, 1120-B Income Tax

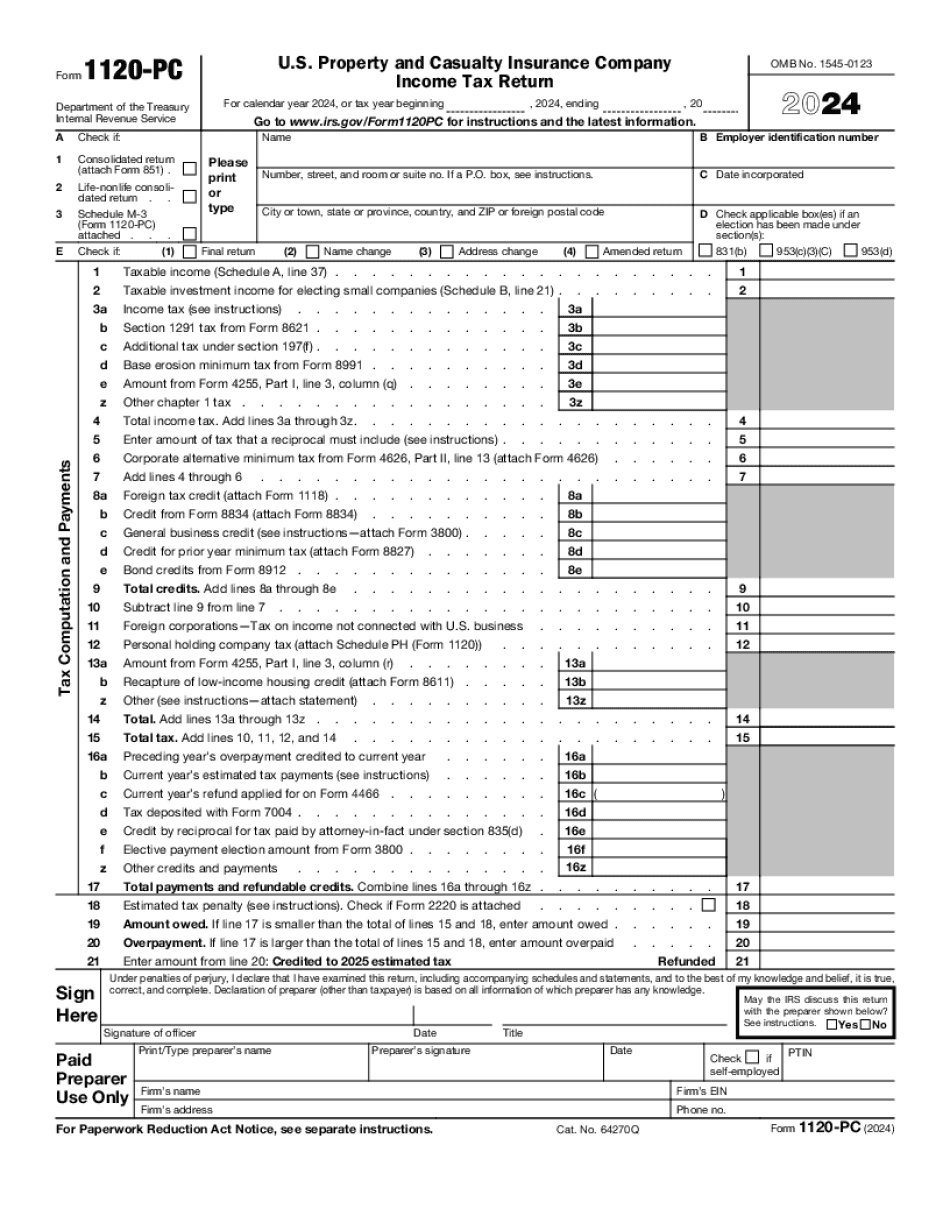

Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return | Internal Revenue Service. Internal Revenue Code of 1986: U.S. Business Corporation, 1120-B Income Tax for Businesses Related Articles General business income tax questions U.S. Business Corporation (U.S.B.C) — Form 1120-B U.S. Business Corporation (U.S.B.C) — Form 1120-W-4 Business income tax in your state Find out which taxes you may owe when business income is earned in a.

The term ``qualified individual'' means an individual qualifying under section

S. Business or a U.S. trade or business interest. The term ``qualified individual'' means an individual qualifying under section 101(a)(15)(U)(i), regardless of whether the individual is also a resident of the United States, or a U.S. or foreign resident, or is not a citizen or national of the United States or any other country. (b) All required and required forms contained in Part I are attached hereto as a consolidated complete copy, as authorized under 28 U.S.C. 2455. (c) A summary or copy of the form is provided in the attachment. A copy of the form may be accessed at. (d) An amendment to this form, if required, may be submitted to: Office of Taxpayer Advocate, P.O. Box 68214, Washington, DC 20. If a copy or summaries of this form are not available, please call the Information Services Division at. For questions or comments concerning this form, please contact ITS. For guidance with the application of the Internal Revenue Code, the Internal Revenue Administrative Regulations, the Internal Revenue Manual, the Treasury Regulations, the Treasury Field Operations Support Center Instruction on Form 1150 and related Treasury Forms, you may contact the Office of Taxpayer Advocate by email at toll-free in the USA, or by fax at. (e) Failure to submit any required information, any change in information, or any request in the timely fashion may result in denial of a claim. The IRS reserves the right in its sole discretion to re-issue a completed Form 1120-PC, U.S. Property and.

You can use this calculator to: Get an approximate estimate of your federal

You can use this calculator to: Get an approximate estimate of your federal and state tax bill Assess the potential impact of certain tax breaks and deductions View a full breakdown of your tax liabilities, deductions, exemptions and tax rate for federal and state income tax and all tax withholding purposes View a list of deductions, credits and other tax-related exclusions you may be eligible to claim Pay your federal and state income taxes Find out your applicable state sales tax Find out which exemptions can reduce your federal income tax liability How do I use this tax estimator? Get a free personalized federal income tax estimator with this year's 2018 IRS tax tables Use the Federal Exemption Calculator to figure out which tax breaks you may be eligible for and how those tax breaks can reduce your federal tax bill Use the Federal Credit / Exclusion Calculator to identify how you can exclude a non-qualifying item and earn a credit for it Find out more about preparing your federal income tax Return Find out more about preparing your state income tax Return Find out about the new Exemption Calculator and the new Federal Credit / Exclusion Calculator for 2018 Return preparation. What are my state's tax brackets? Use our calculator to see our latest tax bracket structure in your.

In PDF form) IRS Publication 2011-62 | Instructions for Filing Information

In PDF form) IRS Publication 2011-62 | Instructions for Filing Information Returns with No Request for Information; and for Filing Tax Return on a Self-Employed Individual Under Section 4980H of the Internal Revenue Code for 2014. (in PDF form) IRS Publication 2011-80 | Form 1040-ES | Filing the Information Returns for 2014. (in PDF form) IRS Form 8952 | Notice of Federal Tax Lien for Filing Tax Return or Return Filed with Electronic Filing.

Forms 1065, 1065A and 1065D Income Tax Return (Form 1065), 1065A Income Tax

S. Federal Exemption Certificate and Certificate of Registration. Forms 1065, 1065A and 1065D Income Tax Return (Form 1065), 1065A Income Tax Return (Form 1065), 1065D Income Tax Return (Form 1065 D), and Form 1065A-E Income Tax Return (Form 1065 E) — Internal Revenue Service (IRS) Government Form in U.S.— Formal. Income Tax Return by a Tax Shelter. Form 1120E-F Income Tax Return (Form 1120E). Form 1045-EZ Individual Income Tax Return — Internal Revenue Service (IRS) Government Form in U.S.— Formal. Form 1045-EZ Individual Income Tax Return (Form 1045), Individual Taxpayer Editing and Information Center (ITEM) Technical Notes, and Form 1045-EZ (a) Individual Form, (b) Individual Taxpayer Editing and Information Center (ITEM) Technical Notes — Taxpayer Editing and Information Center (ITEM) Technical Corrections — Internal Revenue Service (IRS) Government Form. Form 1040 Income Tax Return (Form 1040) — Internal Revenue Service (IRS) Government Form in U.S. — Formal. Income Tax Return by a Business. Form 941 Individual Income Tax Return — Internal Revenue Service (IRS) Government Form in U.S.— Formal. Form 941 Individual Income Tax Return — Internal Revenue Service (IRS) Government Form. Income Tax Return by a Trust. Form 982 Individual Income Tax Return (Form 982) — Internal Revenue Service (IRS) Government Form in U.S.— Formal. Form 982 Individual Income Tax Return — Internal Revenue Service (IRS) Government Form. Income Tax Return by a.

Award-winning PDF software