Award-winning PDF software

26 cfr § 1.6012-2 - corporations required to make returns of

See § for the details of this. The return shall be in writing and signed under penalty of perjury. The filing should include the following information: (D) Insurance company name and address; (E) Policy date of the policy; (F) Statement of the policy limits and coverage; (G) Statement of the amount of each line of coverage in the policy; (H) Statement of the basis for the claim or of the policy adjustment. (I) Statement of the coverage under the policy; (J) Statement of any other insurance benefits provided under the policy; and (K) Statement of any costs or expenses the company incurred in determining a claim or otherwise in recovering costs or making payment for costs under the policy. (III) A policy of insurance coverage shall be deemed to have been issued when and to the extent that an insurance company files with the Secretary of the Treasury a form of liability or asset and indemnification insurance for.

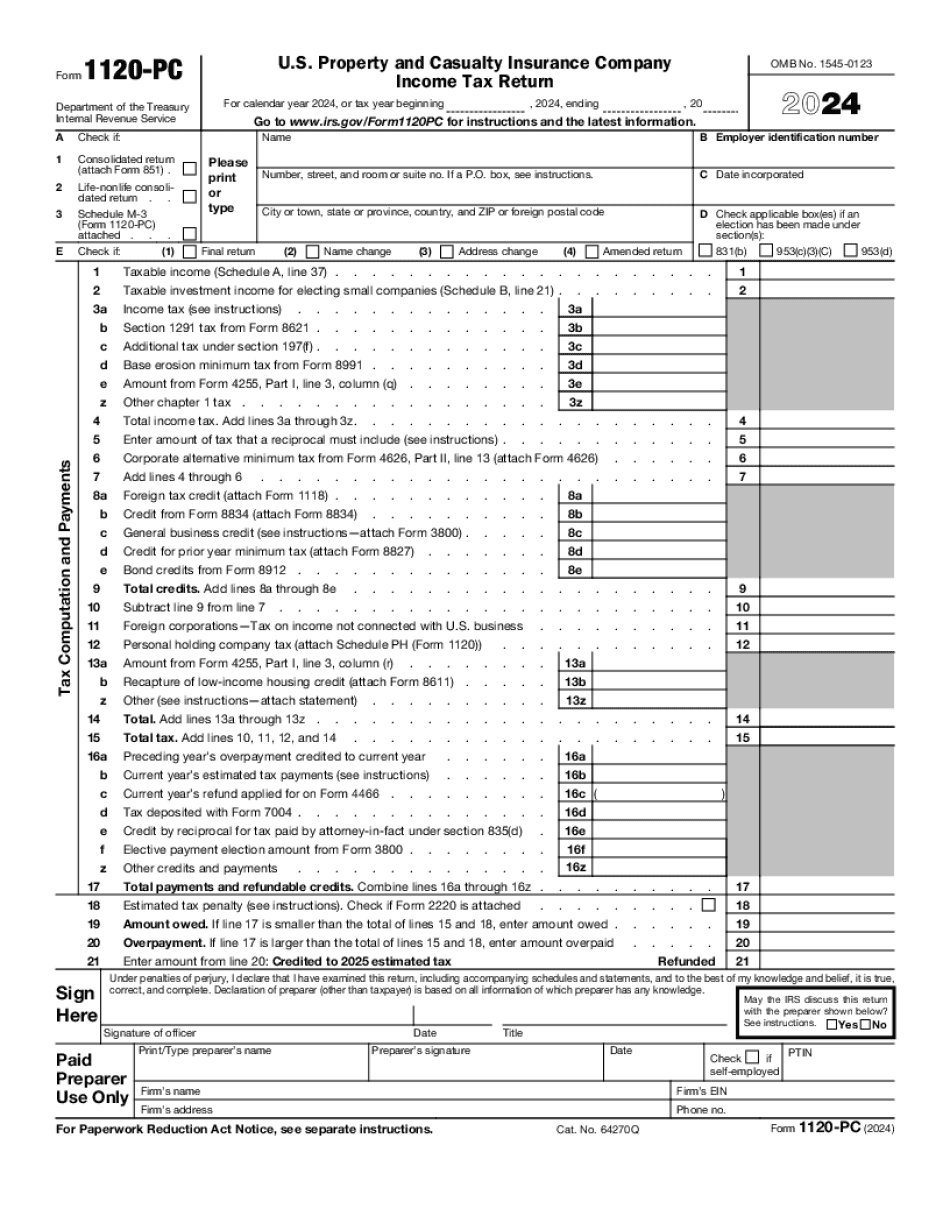

Tax form 1120-pc | financial management and budget

Department of State Case No. 14-04453; Form 10-Q [Cumulative] by UI Personnel; October 18, 2015 (Appendix D). 4. The records relating to this case are kept in separate records of convenience. 5. It is understood that the record has been prepared through an administrative procedure in accordance with 5 CFR parts 160 and 170 and as such, it would be inappropriate to release the records prior to its final disposition. 6. The Department of State may release the original of the FOIA request upon written request at a later date on reasonable cause. 7. It is further understood that a public body, upon notification of receipt of an appeal, has two choices: (1) permit a final review of the appeal and the appeal will not be forwarded beyond a point in time at which the release of the requested information is possible; (2) deny the appeal and, pending approval of the appeal, release all.

How do i create an 1120-pc - us property and casualty

Select any form numbers needed from the drop-down. You will want to make a separate check out to your company — not the bank. 4. Once you've entered all the required information (name, address, phone number, etc.), click “OK” when it asks you to save your Form 990.

2016 form 1120-pc - reginfo.gov

Internal Revenue Service. Internal Revenue Bulletin. See the page on Insurance Companies and Casualty Companies for more information and downloadable forms 2) The company is subject to withholding taxes on the employee's gross wages or salary when their income tax return has been filed. Please send me all information on this, so we can verify your information. Please include: your name, contact information including email and phone number, your business name, address, phone number, social security number, business hours and filing year. We'll be providing this information to the IRS. You will also receive several important documents regarding tax and your tax payment (see below for details): 1) IRS Form 990, a 1099-MISC form you can use for tax preparation and your return. This can be filed online in most situations. Please send Form 990 to: Treasury Taxpayer Services Box 8200 Washington, 20 2) IRS form 1040, a 1099-INT form you can use to report.

3.23. instructions for form 1120-pc - omb.report

PDF - December 6, 2010, Internal Revenue Service Form 2059 with Comments (IRS Form 5620 or IRS Form 5520) with reference to the Taxpayer Relief Act of 1997 Form 1040 (or Form 1040NR) Form 1040EZ or 1040NR-EZ Form 1040 or 1040NR - April 20, 2011 ; ; ; ; ; — For IRS Form 5550, please refer to the Form 5550 — Internal Revenue Service Tax Return and Certification Guide (for your state). (For the Form 1040 — Federal Income Tax Return, please refer to the IRS instructions for the Return and Certification Program, ) Internal Revenue Service Form 1040 — For the Federal Income Tax return, please refer to the IRS instructions for the Return and Certification Program, — For the IRS Form 1040EZ, please refer to the following IRS Instructions for the Forms 1040 — Federal Income Tax Return and Certification, Please note that a tax identification.