Award-winning PDF software

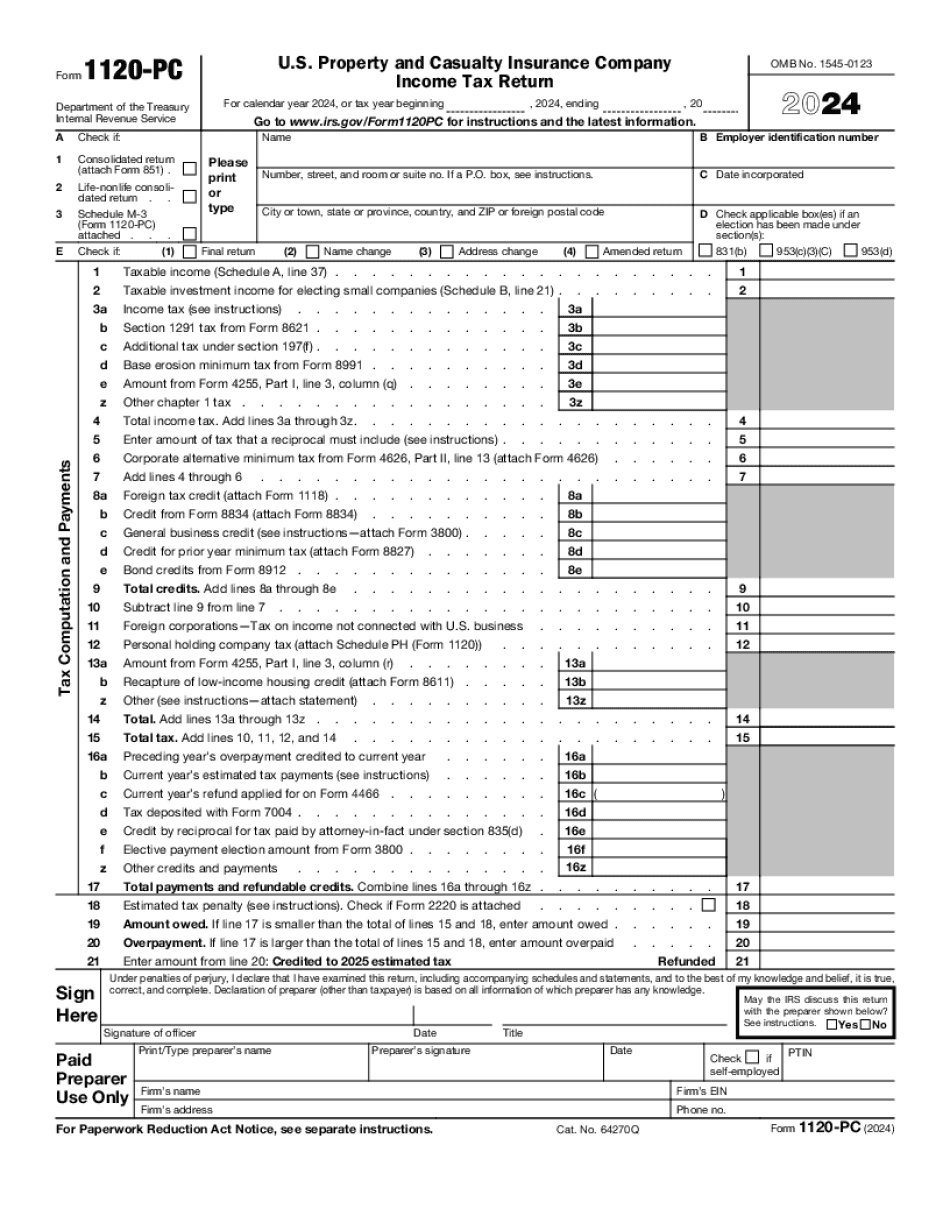

Form 1120-PC for Detroit Michigan: What You Should Know

Relevant Section of the Code on Deductions for Individuals and Corporation. Use section 83 of the Code to: 1031. Short title. This chapter may be cited as the Domestic Corporation Income Tax Act of 2015. 1032. Definition. For the purposes of this chapter, a “domestic corporation” means any corporation duly organized under the laws of the United States, any State, territory, or possession of the United States, or the District of Columbia, whether under the rules or regulations of the Securities and Exchange Commission, and any association duly organized under the laws of anyone or more of those States, territories, or possessions for the purpose of doing business in any part of the United States and the District of Columbia, and any other like foreign corporation subject to a law of any State, territory, or possession of the United States, or a foreign corporation doing business in the United States whose principal place of business in the United States is located wholly within a State or political subdivision of a State, territory, or possession of the United States. (emphasis added) 1033. Exclusion of Domestic Corporation. Except as expressly provided by law, corporations are not liable for tax under this chapter on income from the sale or exchange, or under a contract of sale to the foreign corporation (other than a partnership or other passive enterprise income tax), of any property other than real property, including any interest of, or right to receive from or through, the foreign corporation in, or any contract of, business with, another domestic corporation and an interest in a partnership, joint venture, trust, or estate, or a partnership interest in a limited liability company. 1034. Exclusion of Foreign Corporation. Except as expressly provided by law, corporations are not liable for tax under this chapter on income from the sale or exchange (other than passive income tax, see 1032 above) of the following property: real property of a domestic corporation in which the corporate name appears as the owner or as a partner; certain farm or fishing property; agricultural land, including certain farm and certain fishing property; real estate, including any interest in real property, other than a contract of sale to the foreign corporation of property other than real property; a partnership interest in a limited liability company, including an interest in a partnership. 1035. Regulations.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1120-PC for Detroit Michigan, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1120-PC for Detroit Michigan?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1120-PC for Detroit Michigan aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1120-PC for Detroit Michigan from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.