Award-winning PDF software

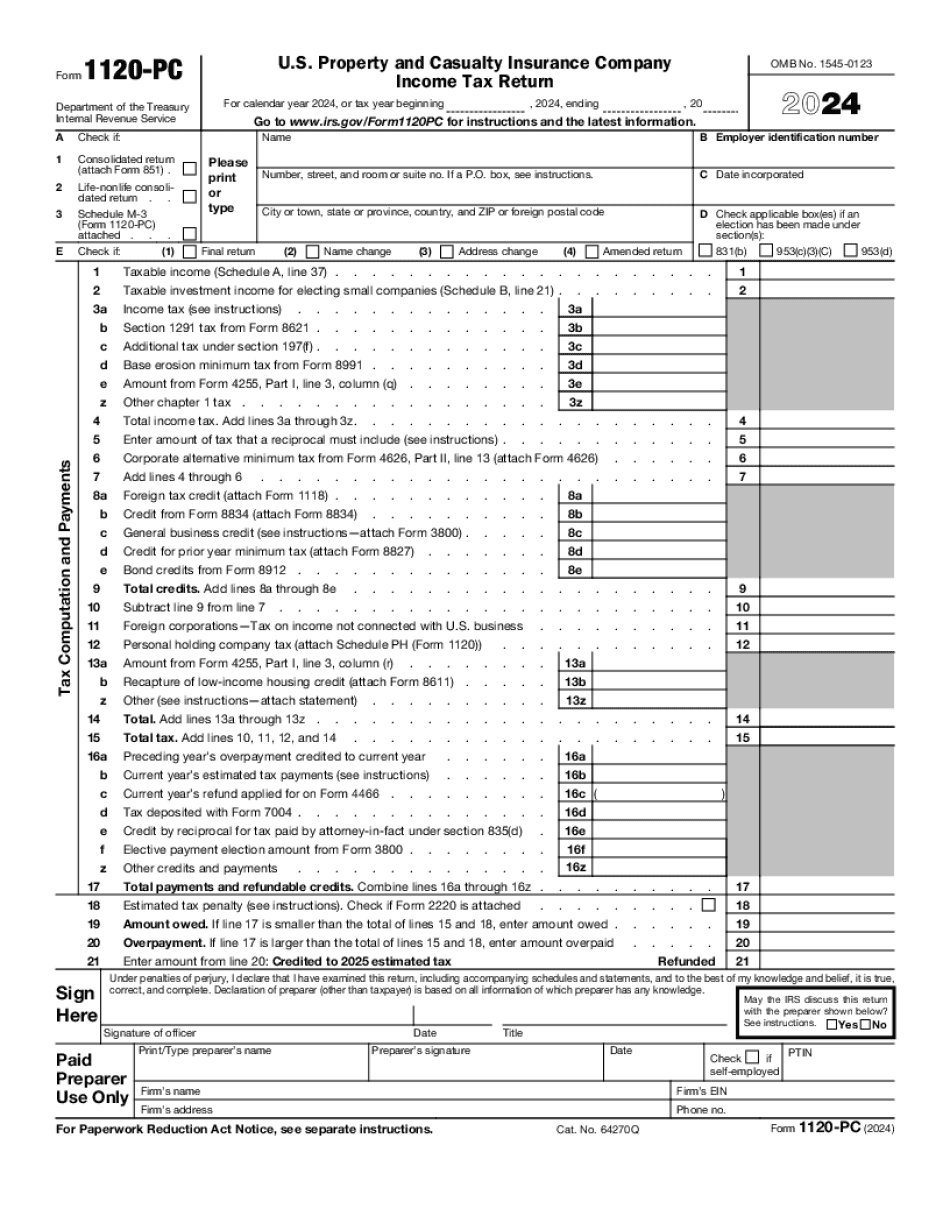

Form 1120-PC for Evansville Indiana: What You Should Know

If you want to use e-filing software, your state may require you to have a tax file number. Check your state's requirements and check online or check the company's website. You can also print and e-file your Form 1120-PC on your state's electronic form. To view your document(s) as well as how to e-file in UCP, see: CLICK HERE FOR E-FILE FORM 1120-PC INITIATING FRAUDULENT RETURNS Indiana has one of the highest rates of tax evasion in the United States. Indiana has a fraud rate of .0267%, which is twice that of Louisiana. This is due to widespread tax fraud and widespread taxpayer ignorance. The fraudulent taxpayers also tend to be on the lower end income scale. These fraudsters also make large fraudulent returns to evade the IRS. To prevent tax fraud, the IRS encourages the filing of valid tax returns. However, it also advises the taxpayer who is making a fraudulent return to pay it back. If you are an individual with income tax obligations, you can be liable to pay taxes on the income you have been using fraudulently. Taxpayers have a strong incentive to fraudulently evade taxes in Indiana. The penalties are very large. If you are a taxpayer with fraudulent tax returns, be sure to read this article, so you can avoid criminal penalties, and also avoid any penalties you incur. ITERATING CERTAIN RETURN TYPES The following documents can be e-filed with UCP, a state tax filing solution from TurboT ax. These can be used with Form 1120-PC or any other IRS Form. For example, we can e-file individual income tax returns and returns involving rental property. The IRS provides free e-file services in certain instances. If you want to do something free you should do that. There are other free tools available, but not quite as easily navigable and intuitive as e-File. See below for the free tools we found. INDIANA REFUTATION BANK (IRB) REFUNDS In Indiana, most tax debt can be repaid in full. However, some tax debt is allowed to be forgiven by the state (usually in the event of death). If the debt is forgiven or forgiven in such a manner, the forgiven amounts do not count against the tax debt's debt limit.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1120-PC for Evansville Indiana, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1120-PC for Evansville Indiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1120-PC for Evansville Indiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1120-PC for Evansville Indiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.