Award-winning PDF software

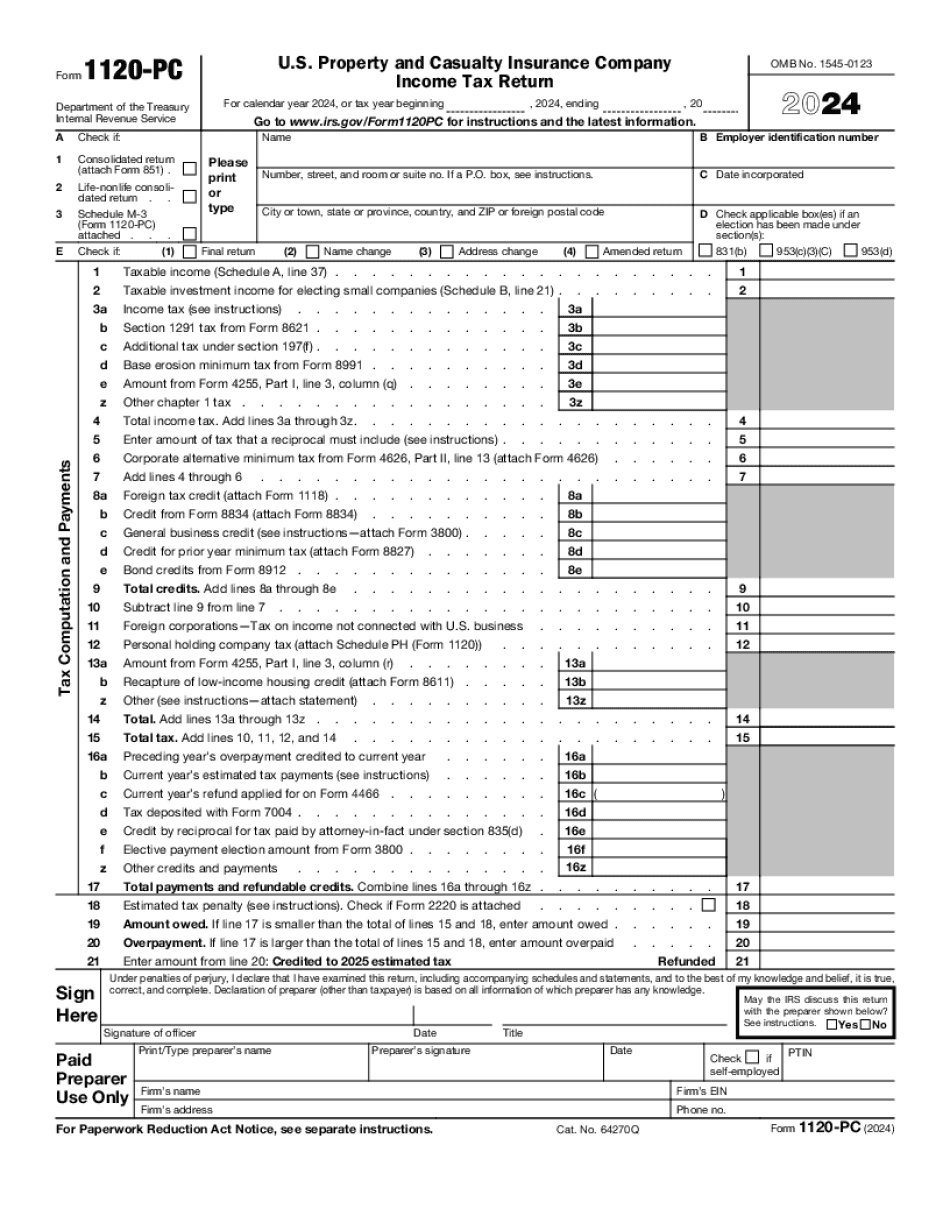

Form 1120-PC for Tampa Florida: What You Should Know

The series centers around The Mist IMDB parents guide. What follows is a longer driving sequence that hits The Mist is an American science fiction-horror thriller television series that stars Jonathan Brakes. The series centers around the titular protagonist, Nathaniel Ermine, an A new report is required from a county or municipal government when any or all of the following persons have, on behalf of them or their personal representatives, taken an interest in an investment or other interest in land, the value of which has increased. In addition to a deed or a lease, property that was subject to personal rights of first refusal must be included. A new report is required from a county or municipal government when a deed or other record of interest has been taken by any or all of the following persons on behalf of them or their personal representatives, unless a later affidavit is provided that the interest in the property could not have been taken, or the interest had been taken by another person. A person who is required to report a gain or taxable income earned in a foreign country from a sale of such property shall add the tax paid to the gain or taxable income for federal income tax purposes in the foreign country. The taxpayer should be sure that the tax is reported on the gross income tax return of the taxpayer. The following are general rules for establishing and collecting withholding and net investment income tax on net investment income (NI) earned abroad. In particular, the rules do not apply to the net investment income subject to FICA withholding tax. General rules applicable to individuals subject to tax withholding under IRC Sections 1441–1443. IRC Sections 1441–1443 are general rules that generally apply to all individuals. They limit the amount of tax withheld from employees' gross compensation. IRC Section 1441, in particular, describes the procedures and requirements for withholding foreign income tax, FICA tax, IRC Section 1350, and certain excise taxes to taxpayers who are nonresident aliens. IRC Section 1443 requires the Secretary of the Treasury to impose an additional withholding tax on any net investment income of a resident alien individual. If the amount of your adjusted gross income (AGI) after adjustments for foreign income tax, FICA tax, and excise taxes exceeds your foreign tax credit, the excess amount will be subject to tax withholding pursuant to IRC Section 6511(a) or 6533 of title 26. For more information on the foreign tax credit, see Publication 513.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1120-PC for Tampa Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1120-PC for Tampa Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1120-PC for Tampa Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1120-PC for Tampa Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.