Award-winning PDF software

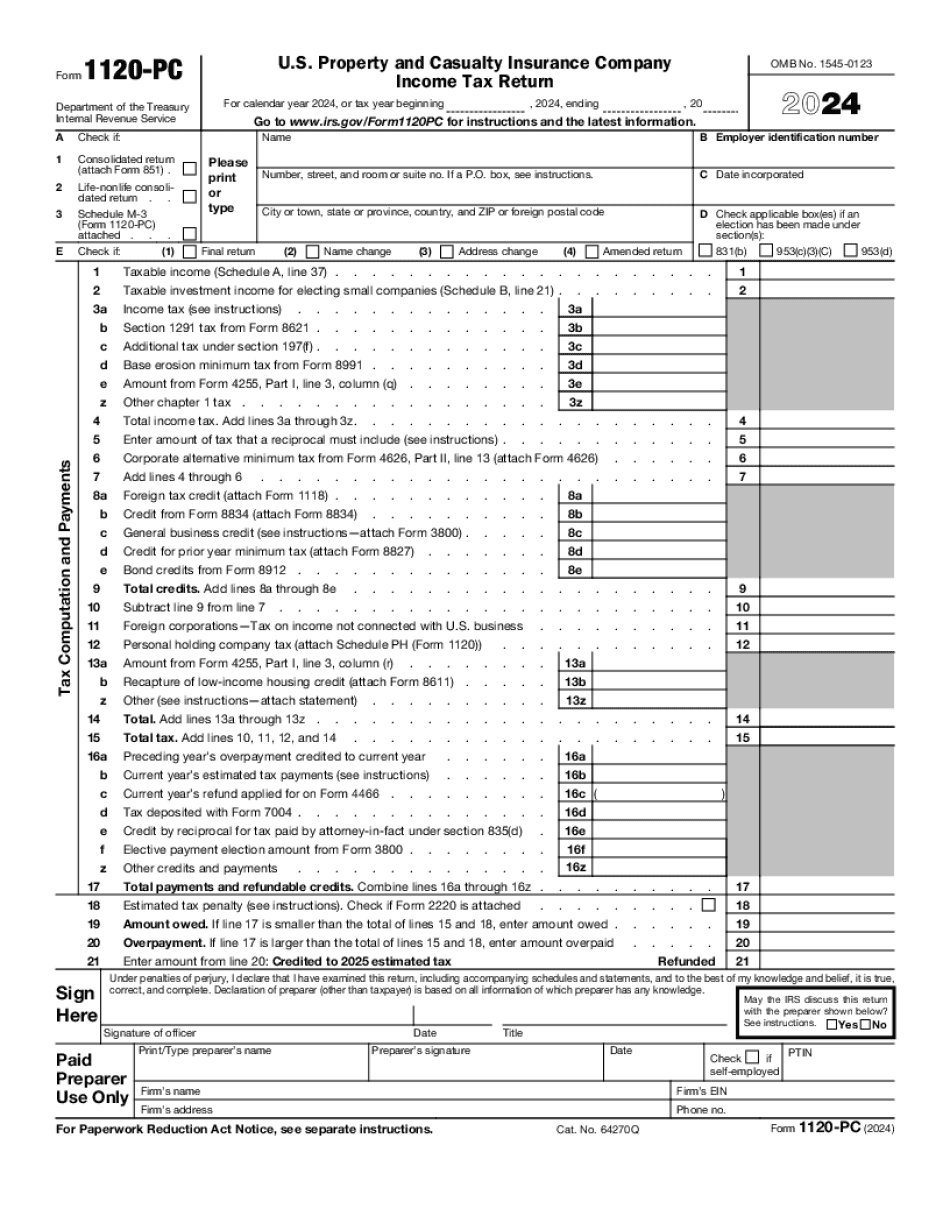

Form 1120-PC Indianapolis Indiana: What You Should Know

Form 709, IRS Business Expenses Reevaluation; INSTAR — Indiana State Exemption Database & Reports On March 15, 2018, The Indiana Department of Revenue released a new tax guidance document explaining, the tax benefits granted to small businesses in Indiana based on three factors: the company's size; the amount invested in the business and the location of the business; and other factors. The document is available to the public and is available without charge via this link. In 2018, the IRS approved a new tax relief for small businesses available only for businesses with less than 600,000 in annual sales. Small businesses qualify for the relief if: the company is incorporated in Indiana; is incorporated to do business in Indiana; and has total assets greater than 5 million. The tax relief applies to businesses with annual gross sales of less than 1.5 million. In 2017, approximately 200 small businesses received tax relief through the business exemption system. In 2017, the IRS approved a new tax relief for Indiana small businesses that is available only for businesses that: have less than 150,000 annually in gross sales; make the majority of their gross sales outside of Indiana; are primarily engaged in one or fewer of the occupations described below under “business activity and occupation” on the Indiana business tax page: manufacturing trade, repair trade, production trade and miscellaneous. On 1 July 2017, the Indiana General Assembly amended the law and added Chapter 1 to Article IX which provides tax relief for Indiana manufacturing trade and repair trade. Indiana manufacturing trade or repair trade includes businesses, whether incorporated or not, engaged in manufacturing, repairs or servicing of goods for sale in Indiana to be repaired or kept in stock at one or more locations.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1120-PC Indianapolis Indiana, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1120-PC Indianapolis Indiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1120-PC Indianapolis Indiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1120-PC Indianapolis Indiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.