Award-winning PDF software

Form 1120-PC online Knoxville Tennessee: What You Should Know

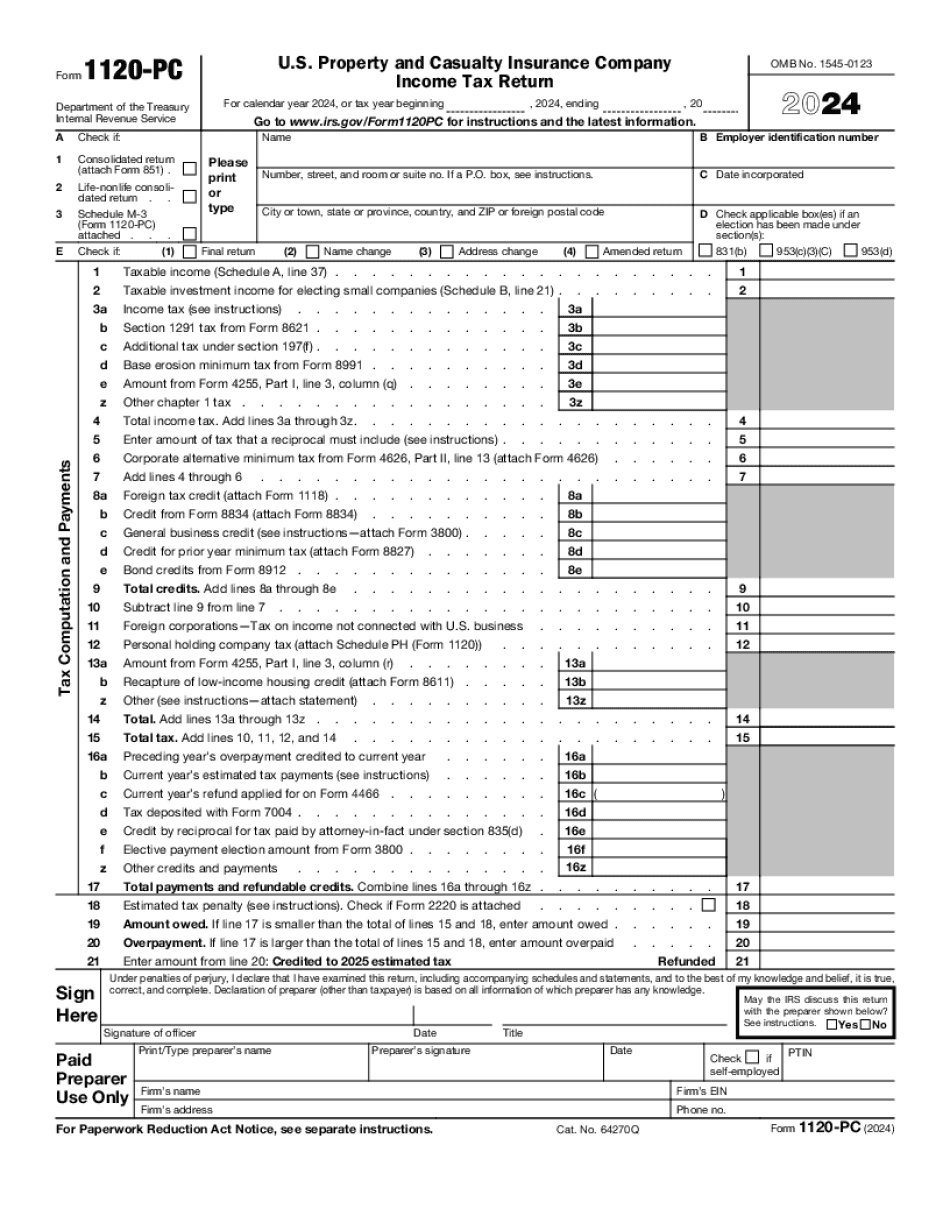

State of North Carolina Department of Revenue Downloading Forms & Publications If you need a form, or you're looking for some help, go to The Tax Tips Blog, an Internet bulletin board of tax professionals who answer tax questions on a daily basis. Tax Tip #8 : How to Avoid Being Fined for a Nonresident Taxpayer Tax Credit If a North Carolina resident or international corporation is subject to federal tax on sales, the tax credit is a cash refund of the tax paid. However, if the sales company is not a resident of the State of North Carolina, you must be a qualified resident. For more information see Form R3015, “North Carolina Nonresident Sales Tax Credit Certificate.” If you can't get the form from a company, go to: If you are a resident or nonresident, and you are filing Form 1120-PC, U.S. Property and Casualty Insurance company Income Tax Return, see: If you are a nonresident with less than 250,000 assets but qualify for the federal refundable tax credit, see: See the NC Division of Financial Institutions' site Filing Guide for Sales and Use Tax on Personal Property. You may also check your federal tax return status using this federal-state form called TurboT ax. Form 1120-PC, U.S. Property and Casualty Insurance company Income Tax Return is in PDF format, so you can print and complete form. Form 1120-PC, U.S. Property and Casualty Insurance company Income Tax Return is in e-book format, so you can download form. For more information, see: Federal tax credit is not taxable. You may get the refund by filing Form 4868, U.S. Nonresident Alien Income Tax Return. Nonresident alien aliens may be taxed on income of their U.S. companies. Nonresident aliens may be subject to tax on all income, no matter what form of income is involved. Form W2 is the corporate income tax form used by most businesses. You should make a copy of the Form W2 available to your employees. Form W-2 is part of your compensation package, and you should give it to your employees. You should get Form W-2 with the pay stubs of your workers. See this article on the IRS About Line 13 Form W-8BEN is a form you need to get from your employer when you get leave time.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1120-PC online Knoxville Tennessee, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1120-PC online Knoxville Tennessee?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1120-PC online Knoxville Tennessee aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1120-PC online Knoxville Tennessee from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.