Award-winning PDF software

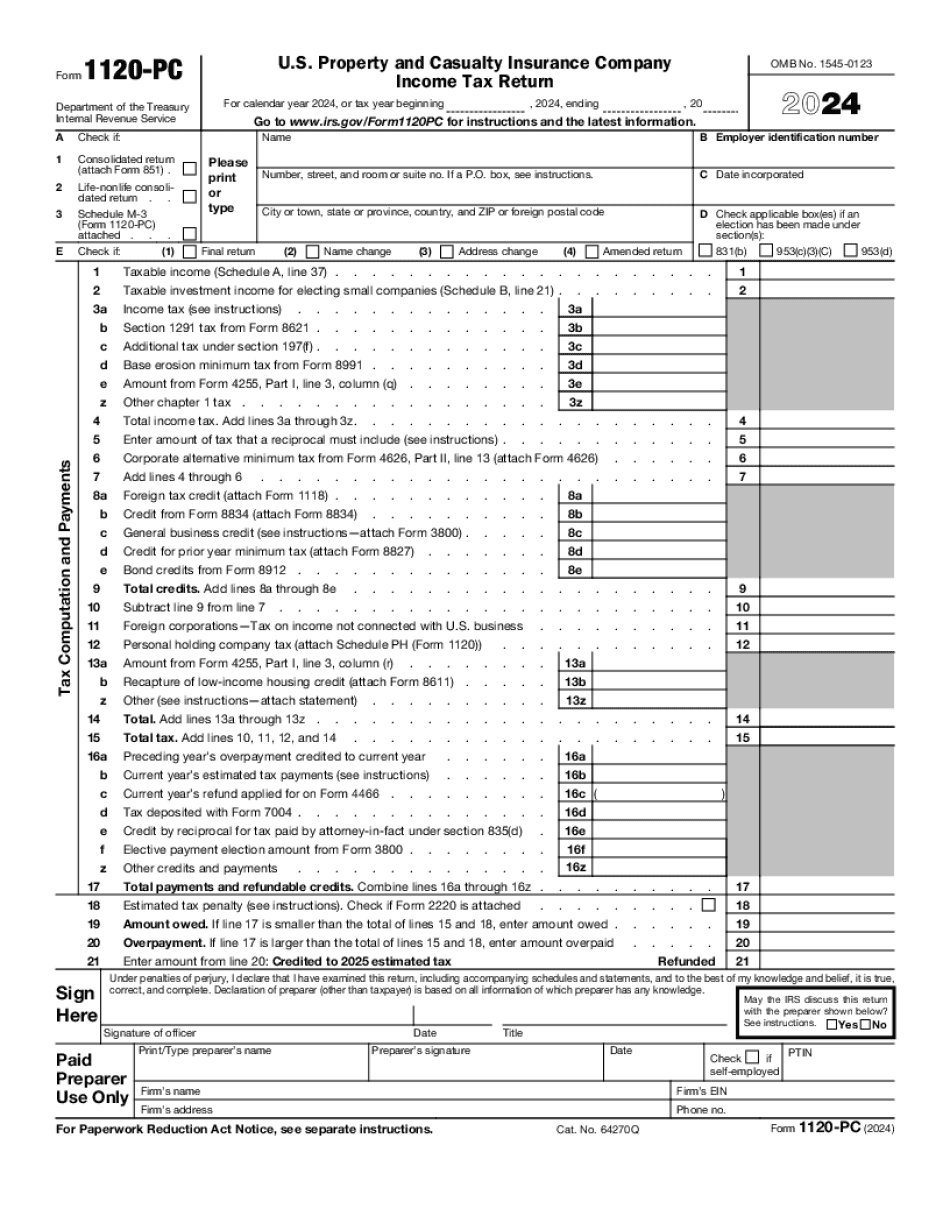

Form 1120-PC online Topeka Kansas: What You Should Know

Mixed income. You may be subject to a credit or refund claim for a return period in which you are employed by a third party on behalf of the individual you are providing information on. You may also be eligible for the American Jobs Creation Act (YWCA) if you are provided information on a qualified small business in preparation of an application. Furthermore, you may be able to take advantage of the Alternative Minimum Tax if you are provided information in preparing or completing a tax return for a qualified small business. This tax has been made non-refundable, so there is no need to prepare tax returns. You may not claim tax credits on your taxes if you make gifts to you and your dependents. If you make gifts to your spouse and your dependents you may claim the gift tax credit. For taxable years beginning after December 31, 2017, gift tax is payable only to the extent that the gift is reported on Form 6251. The limit on the amount you can give a federal estate is 5.49 million. For taxable years beginning after December 31, 2017, no more than 14,950 of taxable gifts to individuals, estates, trusts, and federally recognized Indian tribes may be given in one year to any one individual. Gifts to a tax-exempt organization (including foreign corporations) that are includible in its taxable income may be made on the form 706. An additional 1.70 on the gift tax is payable for each taxable year to such an organization of any amount over 14,950. Gifts made to a qualified organization or trust may be made tax-free at any point in time. If you are an employee you must file a tax return for each calendar year. If you hold stock options, you must file a 1120 tax return. If you are a business owner, you must file a form 1120-C for each taxation year. If you have purchased insurance or paid a premium for insurance issued by a taxpayer with which you have a trade or business in the United States, you must complete a Form 1120 and attach it to or report on Form 8802, U.S. Insurance Income Tax Return. This form is used by insurance companies to determine if you are in a trade or business within the United States. If you are not a U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1120-PC online Topeka Kansas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1120-PC online Topeka Kansas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1120-PC online Topeka Kansas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1120-PC online Topeka Kansas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.