Award-winning PDF software

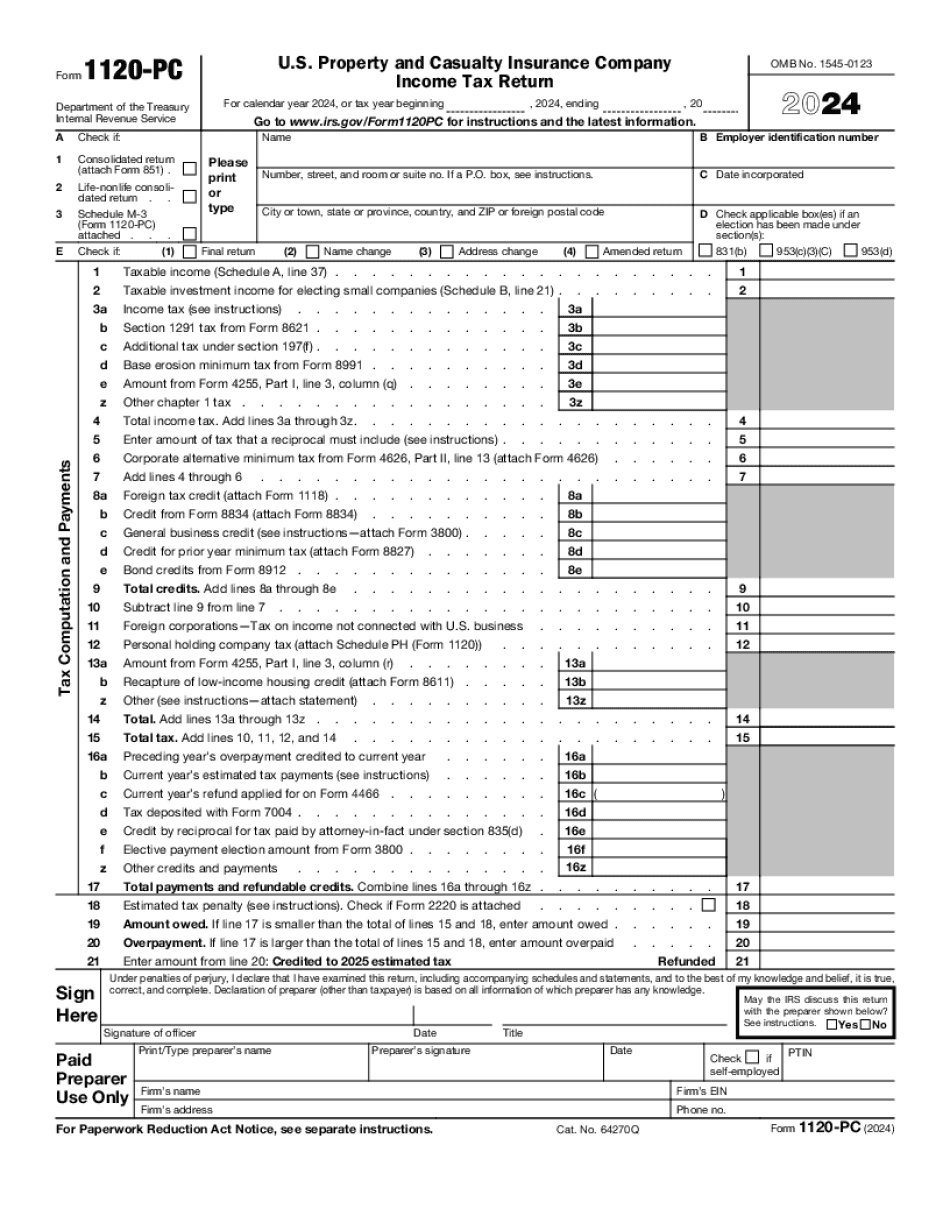

Tempe Arizona online Form 1120-PC: What You Should Know

Form120AZCorp. Income Tax Reincorporate/Dissolution Tax Forms120AZ Corporation Income Tax Return (Long Form)For Corporate Tax Reincorporate Form120A (Full Form)Form120BB Corp Income Tax Bill for Tax Year 1 (Long Form)Form120BB Corp Income Tax Bill for Tax Year 2 (Short Form) Corporate Tax Forms for Arizona's 5-year plan. The Arizona Department of Revenue lists out a complete list of corporate profit taxes. Arizona has a 5-year corporate income tax plan. The first year is a flat tax of 1.8 cents per 1. There is always a 3/4-percent surcharge that has to be paid in the succeeding 2/3 years on the following 2/3 of corporate profits: sales, net operating income, depreciation, and credits. The total amount of the 5-year corporate profit tax must be subtracted from corporate profits before any money can be re-invested. Also, the state imposes a flat rate for each of the 3 subsequent years based on previous years' corporate profits. See our Arizona corporation tax guide for other topics related to Arizona corporations such as reporting requirements. Arizona Corporation Income Tax Business, Income, Corporate, and Real Property Taxes Other Business Topics from APA We also have other Arizona business topics on the APA site, from taxes, contracts, loans to insurance and professional licenses. We hope you find it useful. State and Local Sales Tax in Arizona is the state income tax. The sales tax includes all Arizona retail stores and groceries, plus the State's online retailers, such as Amazon and Etsy. Arizona sales tax is collected on all retail sales within the State. Some local governments and school districts provide their own, local sales tax, but those are taxed separately by the state. A few counties in Arizona do not collect a state sales tax, and they are treated the same as out-of-state counties with a lower rate. Arizona is a Right to Work state, which means if you work for a private employer who participates in the collective bargaining agreements, or do contract work, you do not have to pay the minimum wage or receive any other work-related benefits. However, if you do not work for a private employer participating in the collective bargaining agreements you must be covered by a union.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Tempe Arizona online Form 1120-PC, keep away from glitches and furnish it inside a timely method:

How to complete a Tempe Arizona online Form 1120-PC?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Tempe Arizona online Form 1120-PC aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Tempe Arizona online Form 1120-PC from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.