Award-winning PDF software

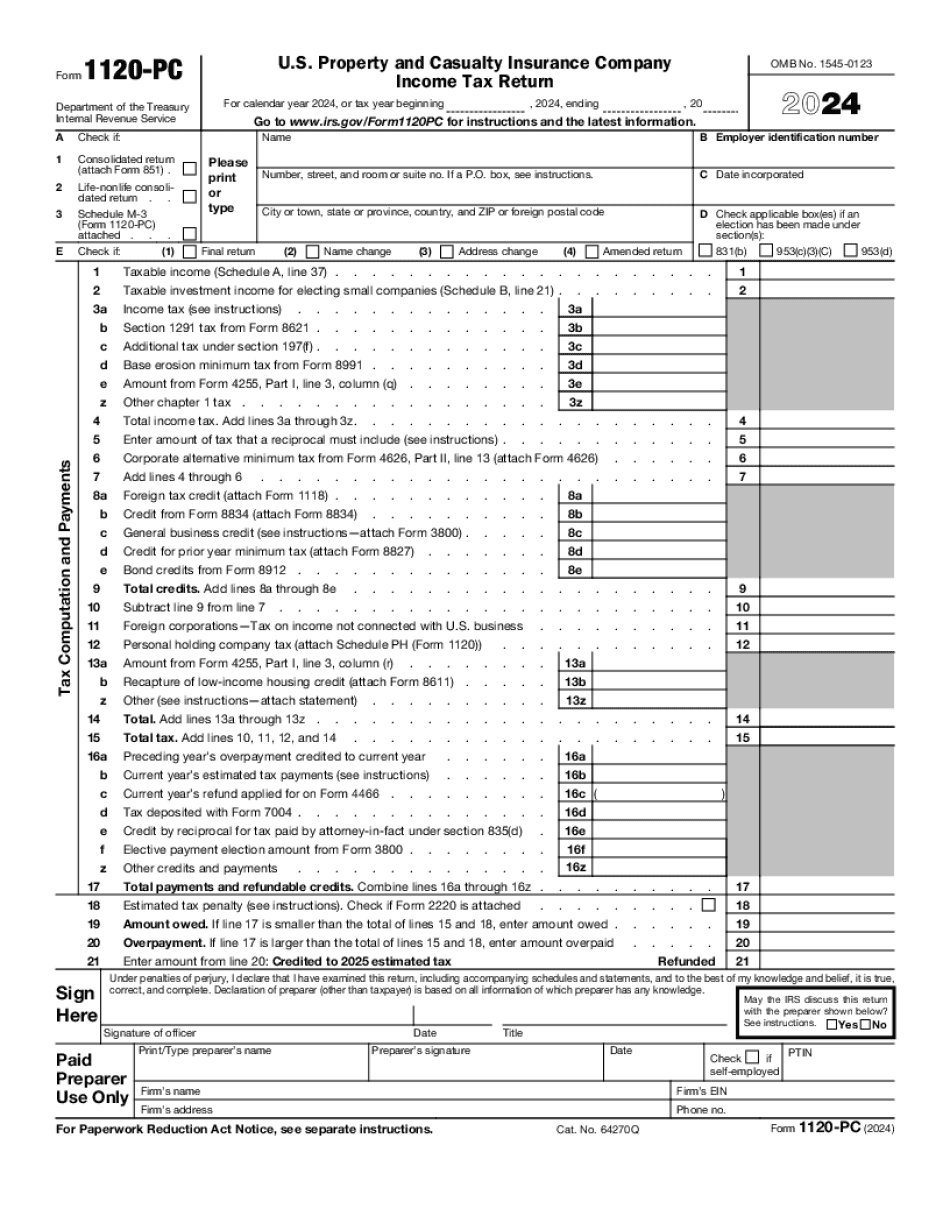

Yonkers New York online Form 1120-PC: What You Should Know

Dec 2, 2025 — If you own more than 5 units you are required to purchase property with one and a half times the price of each unit, on which you carry a mortgage or a deed in trust (or an instrument containing title), and file Form 1120‑D, Summary Report of Property Income, if there is any income earned, whether that is subject to Medicare tax, from your real property holding, in the aggregate. This requires a minimum of 25,450 in taxable income. These units are called “taxable-interest real properties.” (See Tax FAQs — Real property tax). See the Tax Calculator. You can also read about the new tax on the form for real estate brokers. Dec 31, 2025 — For New York state tax purposes, all amounts received by one person at any one time from another person are considered as earned income and as taxable-interest real properties. If you are paying more than your due as an installment payment on a mortgage, a deed in trust, an insurance contract, or a partnership interest, see Tax Calculator. You can see what you can afford on Tax-Filing-Guide.com Dec 31, 2025 — This year, many corporations who have tax years ending after Dec 31, 2025 will have their tax rates for that year reduced due to the changes in effective tax rates by the Federal Individual Income Tax Act (“FINRA” or “FIFA” or “FIT” for short). This means that in 2025 a corporation will no longer owe corporate income tax on gross receipts of more than 250,000 unless that gross receipts figure includes 500,000 in “passed over” income (generally income from a partnership). (See: Tax Rates by Year 2018, Tax Rates, 2025 and 2017.) A corporation also no longer owes tax on gross receipts of more than 500,000 from a self-employment plan (a nonpassed over income tax credit can reduce your federal tax bill). If this applies to you your tax will be lowered to 25 percent of your gross receipts.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Yonkers New York online Form 1120-PC, keep away from glitches and furnish it inside a timely method:

How to complete a Yonkers New York online Form 1120-PC?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Yonkers New York online Form 1120-PC aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Yonkers New York online Form 1120-PC from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.