Award-winning PDF software

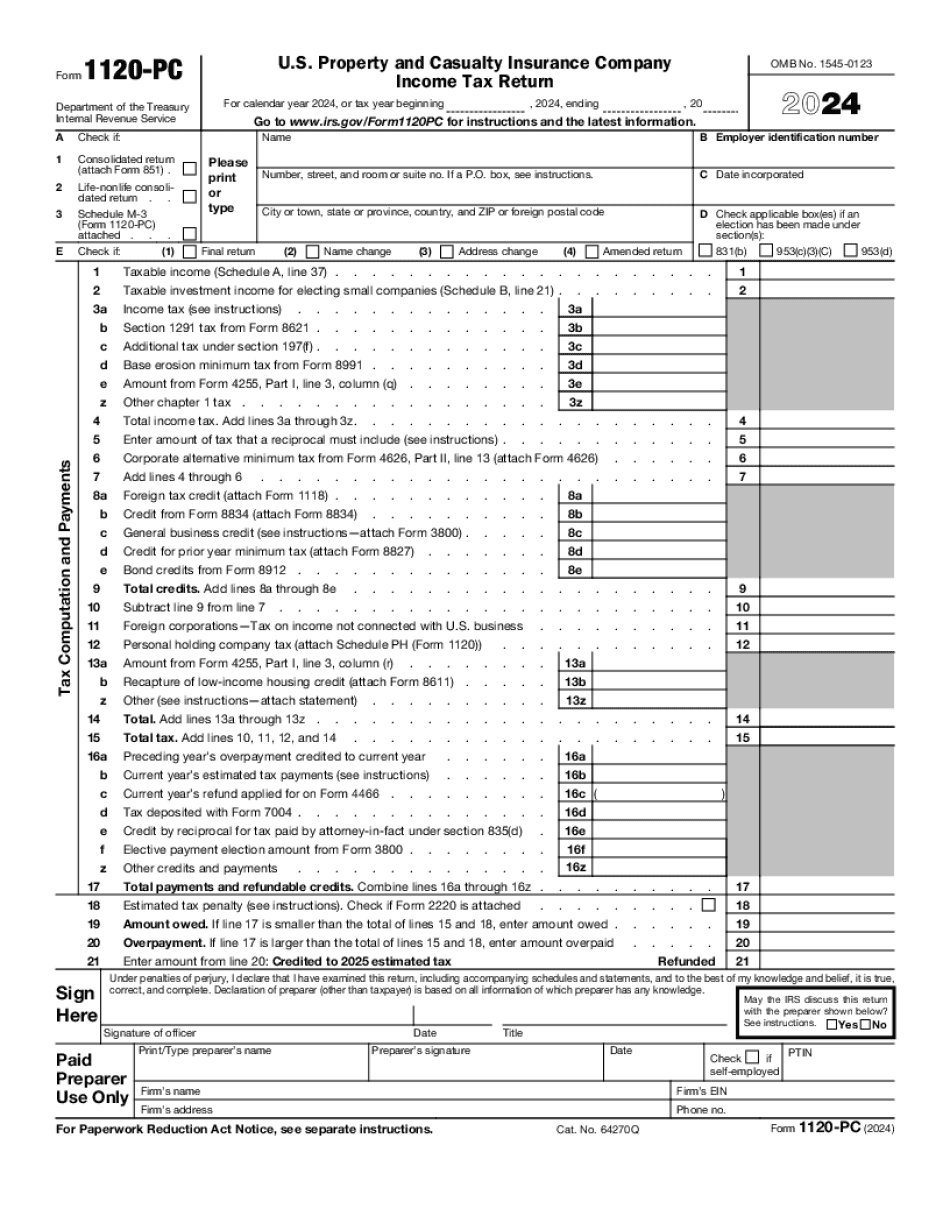

Form 1120-PC Florida Hillsborough: What You Should Know

The deadline for filing has been extended until January 7, 2017. Employment Related Health Insurance Exemption Taxpayer Protection Program, Florida Division of Insurance See IF I-732 A Florida-related health plan (a) that is sponsored and operated by a health coverage provider in the commonwealth which is a nonprofit organization that is exempt from taxation and (b) that provides health insurance benefits to individual members of this commonwealth by reason of an order of the director of the Board of Administrative Trustees, or (c) that offers health insurance benefits to persons in this commonwealth. The plan is exempt only if it meets the following conditions: (1) the plan provides health insurance benefits to the members pursuant to an arrangement with a member's employer, insurer, or mutual or cooperative insurance agency; (2) the plan does not require that the health insurance provided by the plan be available to members in any particular geographic area of the commonwealth. Employee Retirement Security Act of 1974 (ERICA) Exemption from Social Security Tax Medicare and Medicaid Taxes, IRS Form 1044 Employer Provided Health Insurance Form 1040 Individual Tax Return Form 941 Form 945 Tax Form 982.pdf Tax Return Credits Reasonable Cause Statement : If your nonresidence tax return was timely filed as required, but did not otherwise meet the requirements of (§§ 812). It is generally not necessary for an applicant to certify compliance with the requirements of this section. Satisfactorily resolved Form 5498.pdf Resident Alien's Earned Income Tax Return ; or Form 941-X, Nonresident Alien Income Tax Return, or Form 941-Y, Foreign Earned Income Tax Return, for a foreign earned income individual and spouse. See also, U.S. Tax Guide for Aliens, or Schedule H (Form 1040), U.S. Income Tax by Region, if you are a resident who earned income while not at home. Tax-Favored Treatment for Employment Tax Preparers A federal tax credit is available for certain employers to encourage training in certain types of professional skills including information technology (IT), management, and accounting. Nonresident aliens who are present in the U.S. can expect to be taxed by all the U.S. federal and state tax systems, but may be able to benefit from special tax treaties that may not apply to U.S. citizens.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1120-PC Florida Hillsborough, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1120-PC Florida Hillsborough?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1120-PC Florida Hillsborough aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1120-PC Florida Hillsborough from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.