Award-winning PDF software

Form 1120-PC for South Carolina: What You Should Know

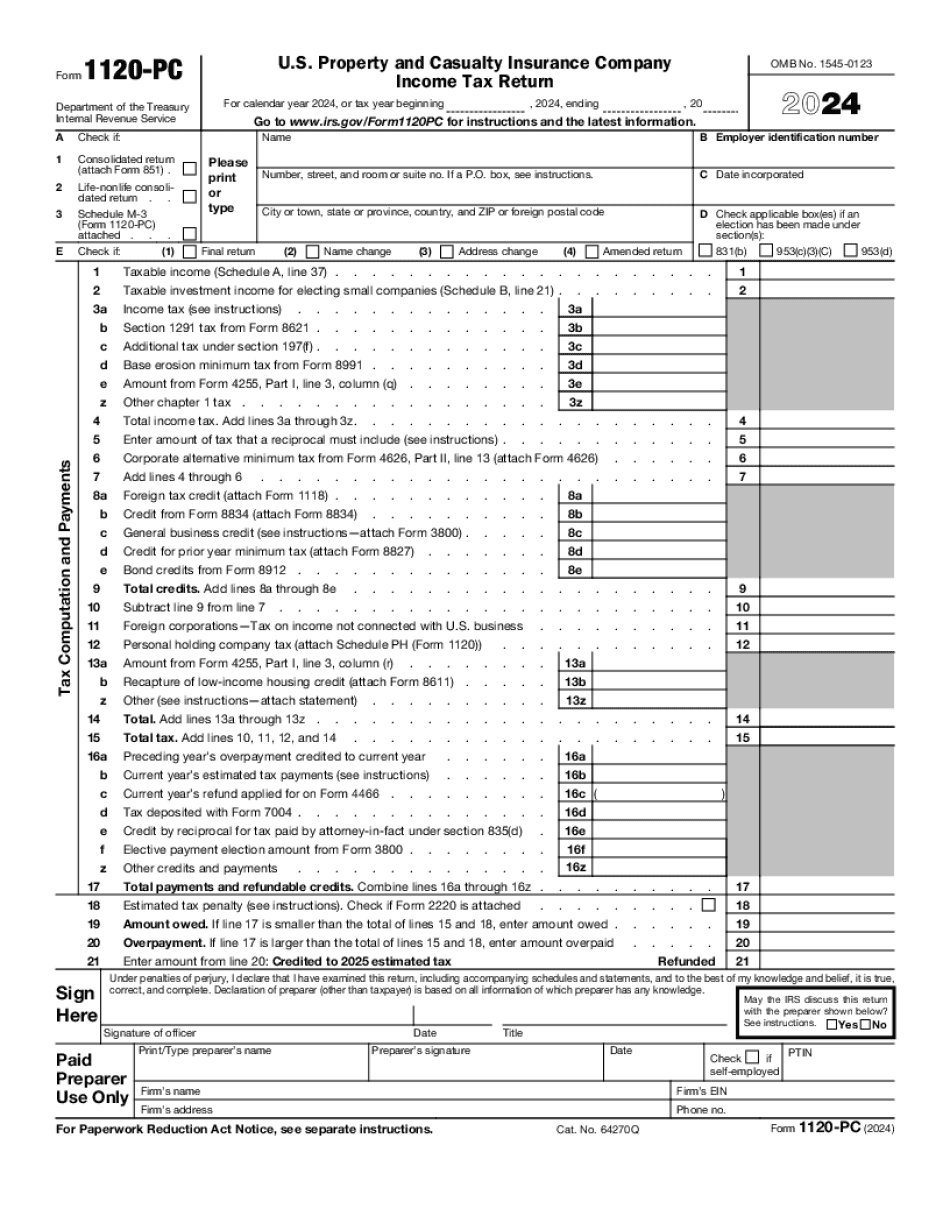

Instructions for Form 1126-SC, U.S. Tax Return for Corporations — Federal Tax Office (FTA) U.S. Property and Casualty Insurance Company Income Test For U.S. property and casualty insurance companies that are not a C Corporation: First, see that the company has no substantial assets other than the property to be covered by a policy. You must review each policy separately. If there is another insurer, check to see whether they also are required to pay the U.S. tax. The company may be owned by another company or a U.S. company. If the company is a foreign insurance company, and their U.S. insurance agent is located in the U.S., they are not exempt from the U.S. tax. A U.S. agent that is located outside the United States should obtain the required license from the U.S. Department of the Treasury (DO) before providing claims and insurance services. If the company has a U.S. agent located elsewhere and the agent has been in business for less than one year, have the agent provide a statement to us indicating his or her location. If the company is an insurance company other than a U.S. insurance company, see that the policy is: A self-insured contract Ineligible for the policy. (This is usually true for non-U.S.-based insurance.) Self-insured contracts will be considered for self-insurance by the IRS. This means that if the company pays part of the insurance premium, part of the premium will be considered a tax credit to reduce income tax liability on the income tax return. In this case, the amount of the tax credit should be entered as a deduction as discussed in section 6012. The portion that is to be paid out of the premiums on the income tax return will be discussed in the next section. If the company is a U.S. insurance company and the insured does not want his or her insurance policy to be self-insured, the company should be asking for a certification from the insured regarding coverage and his or her preference for the self-insured status. For a U.S. insurance company, a certified letter from an insured providing a written explanation of his or her U.S. insurance policy should be kept. The letter should be kept in case the insured elects the tax benefit described above in section 2.01.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1120-PC for South Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1120-PC for South Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1120-PC for South Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1120-PC for South Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.