Okay, for this video, I wanted to go through a very simple tutorial on how to complete an initial year Form 1120s for an S corporation. So, the example we're going to be going through, like I said, it's going to be very straightforward. Just some simple income and expenses, a couple of shareholders. We're going to walk through the return, look at the financial statements, and the fact pattern itself. I'm going to go through not only the financial statements but also each part of the return and the K1s, and show you how these things should be populated and completed. I've got a couple of items in front of us. We've got obviously the 1120s itself, and I do have one slide here with the very simple fact pattern that we're going to be working with: how the company was formed, who are the owners, and some high-level income and expenses. Then, I've also got an Excel spreadsheet here where we've got the profit and loss for the company for the year, and then we've also got the balance sheet for the company for the year as of December 31st, 2021. So, the best place to start here is certainly going to be looking at the fact pattern itself, right? So we can get kind of an understanding as to when was the company created, what does the shareholder makeup look like, and so on. That'll be our foundation to start building the return. So, if we start at the top here, we have a company that's formed by three individuals: John, Jane, and Frank. They decide to form a marketing consulting company in the state of Delaware. They prepare these articles of incorporation, and within the articles, it says that the company is allowed to issue 5000 shares of Class...

Award-winning PDF software

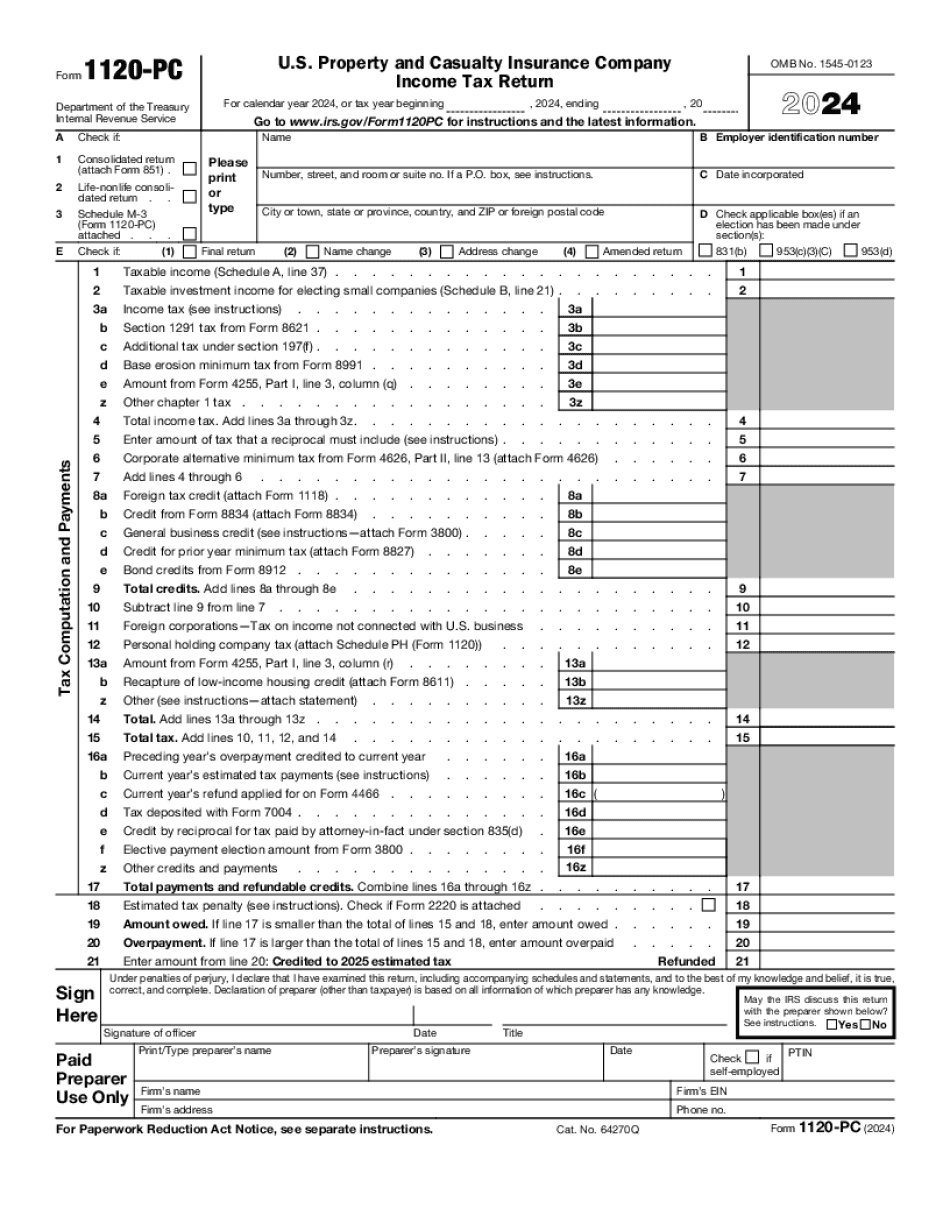

Video instructions and help with filling out and completing Form 1120-PC vs. Form 1120s