Award-winning PDF software

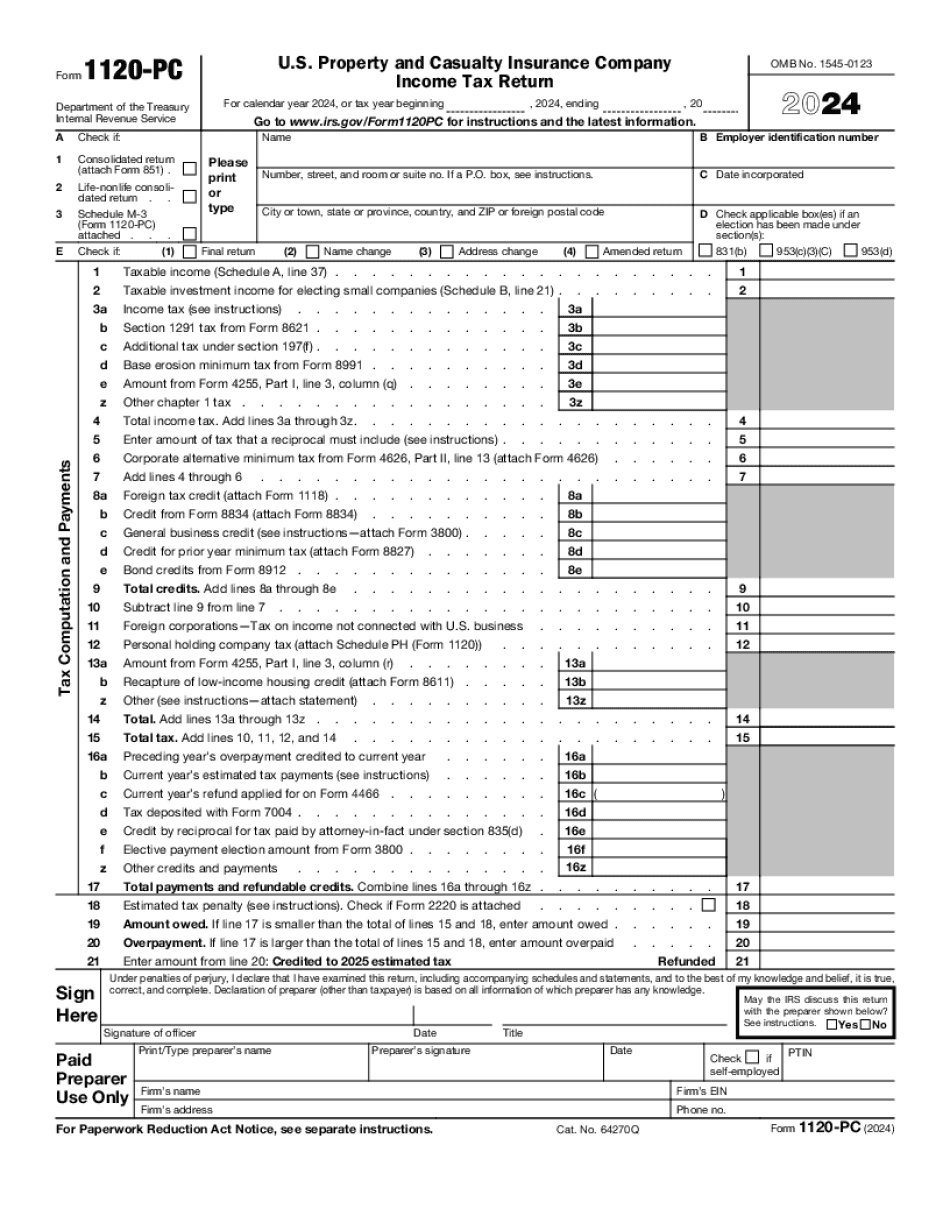

Printable Form 1120-PC Omaha Nebraska: What You Should Know

EFT: Sales tax rate: 1.07% (7.5 cents on the dollar) EFT: Tax base: Colorado Revised Statute 10.3-1303. Colorado Revised Statute 10.3-1303, Section A. EFT: Sales in Colorado: State sales tax will apply. See more about Colorado business income tax rates See more about Colorado sales tax rates Filing Requirements Colorado sales tax laws require that you must file a sales or use tax return with the Department of Revenue. For more information about Colorado sales tax laws see the Colorado Revised Statutes and the Colorado Commerce Clause Colorado Sales Tax Rates Retailers cannot charge you a special tax rate which may differ from the state's standard rate. In general, Colorado requires that retailers charge the state's rate on all sales. However, if the retailer charges a higher rate on purchases made by those purchasing more than 15,000 of products over a calendar year. Then the retail store may also charge a sales tax which is not subject to the Colorado Department of Revenue. In such cases, the retailer must pay the tax to the state if that rate is higher than the state's standard rate of 6%. Nonresidents of Colorado must file an annual Form 1120-PC with the Department of the Treasury by the due date of the return. See also: Colorado Sales Tax Rates Example : If you make your last purchase in Colorado on October 28 and the last bill for those items is submitted to you on November 16, the nonresident purchases need to file an Annual Income Tax Return for Colorado at the later due date of the return. Retailers pay the sales tax to the state. For further information about the payment of Colorado sales tax, see here. Colorado Sales Tax for Vehicles The Department determines the Colorado tax rate on Colorado vehicle purchases. The amount of tax on the sales price depends on which Colorado state sales tax rate applies to that automobile. Use the table below to determine the tax as the applicable Colorado state rate. The taxable amount will be divided between the seller. If the Colorado vehicle is sold as a passenger car, you will pay 5% tax unless certain rules apply. If the Colorado sales tax rate applies, then you will pay no tax on that sale. For more information, see: Colorado sales tax for vehicles.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1120-PC Omaha Nebraska, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1120-PC Omaha Nebraska?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1120-PC Omaha Nebraska aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1120-PC Omaha Nebraska from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.